Categories for

Two Ways to Measure Revenue Per User

When it comes to measuring revenue, it’s essential that businesses analyze it from a variety of perspectives. While there’s revenue and net income on an income statement to show a company’s quarterly financials, another way to measure it is through ARPU (average revenue per user) and ARPPU (average revenue per paying user).

Defining ARPU

ARPU is the average revenue per customer or per unit. It looks at how much revenue is earned over a particular timeframe (multiple times a month, quarter, half-year or 12-months) divided by the average patron during the same timeframe. This can be applied to many different types of companies, including social media and software as a service (SaaS). It’s calculated as follows:

ARPU = Total revenue/Average units or subscribers

ARPU = $10,000,000/100,000 = $100

Interpreting ARPU

This is a snapshot of a company’s profitability. It’s a way for companies to track revenue generation over a short or long period. With this information, a company or investor can analyze the business’ past and present performance. It can help determine whether or not the business needs to re-evaluate its operations and product models or if an investor should invest in a company.

When it comes to evaluating an investment, if one company in a specific industry is generating an ARPU of $5, and another company is generating an ARPU of $3, the first company could be a more attractive investment. Similarly, if the trend of a company’s ARPU is increasing, it’s worth looking at how the company’s stock has performed. Additional investment research can determine how the company’s stock price appreciated.

Average Revenue Per Paying User (ARPPU)

ARPPU is used to determine the average revenue from a company’s paying customers only. To contrast this measurement type, ARPU factors in all users.

Assume the following: A business had revenue of $2 million, an average user base of 1 million and an ARPU of $2.

If, however, we’re looking at the ARPPU, we need to take out the non-paying user base. If the non-paying user base is determined to be 425,000, the remaining, paying base is 575,000. Use the following formula to calculate ARPPU:

ARPPU = Period of Recurring Revenue/Active Paying Users during the same measurement period

ARPPU = $2 million/575,000 = $3.48 per active paying user

Interpreting ARPPU

When the ARPPU is low, this indicates the business’ products or services aren’t well received by customers and those to whom it is marketing. A higher ARPPU indicates a company’s marketing efforts, products, and services are received well by customers. Similar to ARPU, results from ARPPU can be analyzed for trends to see when products or services are well received; and then investigated to determine whether it is influenced by the sales and marketing, customer service, product quality, etc.

Whichever way a business analyzes its sales and revenue generation processes, taking multiple approaches can provide different perspectives to help owners and employees determine when and where to make improvements to its operations.

Streamline Your Business Finances: QuickBooks Online Fund Recording Tips

As the business world becomes increasingly competitive – and increasingly digital – it is essential to maintain meticulous financial tracking and accurate recording of all incoming funds. QuickBooks Online (QBO) is an excellent resource for small business owners who are looking to do their recordkeeping in the cloud. Whether you’re receiving payments for invoices, documenting instant sales, or conducting business on the go, the platform equips you with the tools you need to ensure that all of your income is correctly recorded.

Delayed Payments

If your business involves sending invoices for products or services, QBO offers multiple ways to record payments when they come in. You can opt to open the invoice directly and click on the “Receive payment” option in the upper right corner. However, accessing the “All Sales” screen provides an opportunity to review the status of other pending transactions. To navigate to this screen, click on “Sales” in the toolbar, then select “All Sales.”

For those with extensive lists of sales transactions, using the Filter tool can streamline the process. Click on the down arrow next to “Filter” in the upper left to explore your search options (e.g., Status, Customer).

Once you’ve located the correct invoice, navigate to the bottom of that row. In the “Action” column, you’ll find the “Receive payment” option. Feel free to explore other available choices by clicking on the down arrow. When the “Receive Payment” window appears, specify the applicable payment method, leave the “Deposit to” field set to “Undeposited Funds,” and double-check that all information is accurate. You can print the receipt or add attachments using the provided links, then save it.

Pro Tip: Offering customers the option to make online payments tends to expedite the invoice settlement process.

Instant Payments

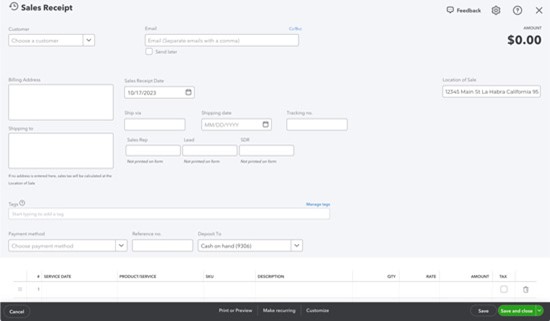

In situations where your business receives payments at the time of product or service delivery, issuing a sales receipt – rather than an invoice – is the way to go. this is also essential for your records. Simply click on the “+New” button in the upper left and select “Sales receipt” under Customers to open a blank form. You’ll fill it out in a manner similar to creating an invoice. Start by selecting the customer and proceed to input or select any necessary data for the remaining fields.

If you find yourself not needing all the fields on your sales forms, don’t hesitate to remove some or add custom ones. The beauty of QBO is that you can make it work for your company.

Going Mobile

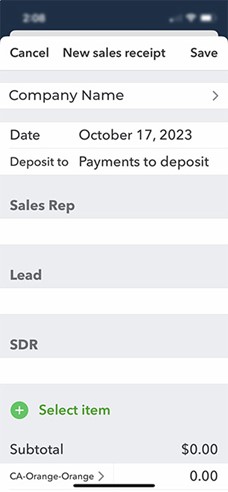

For those who conduct business on the go, the QuickBooks mobile app makes it simple for users to create sales receipts for your customers. By clicking on the plus (+) sign at the bottom of the screen and selecting “Sales Receipt,” you can access a form similar to what you’d use on your desktop computer. The layout may differ, but the form’s functionality remains intact.

Having a QuickBooks Payments account is especially helpful when you’re making mobile sales. You can even accept credit and debit card payments by ordering a card reader directly from Intuit.

Accurate payment recording is always essential. Nowadays, with the IRS cracking down and business regulations changing all the time, it’s more critical than ever to ensure that every dollar is accounted for. QuickBooks online allows you to become a more confident business owner.

Home Energy Audit Tax Benefits

Have you been thinking of making home improvements? If so, and they include energy saving improvements, you may qualify for some substantial income tax credits. Even if home improvements aren’t currently on your to-do list, with the increasing cost of energy you may find that energy saving home improvements, along with the tax credits that accompany them, are something you should be considering.

Don’t know where to begin? Perhaps a good starting point would be with a home energy audit that identifies the most significant and cost-effective energy efficiency improvements you could make with respect to your principal residence, including a written estimate of the energy and cost savings with respect to each improvement, allowing you to pick the ones that best serve your needs and finances. In addition, the tax code now includes a tax credit of 30% of the cost of a home energy audit performed by a qualified home energy auditor up to a credit of $150 per year. The home energy auditor is required to provide you a written audit report. This credit is in addition to the annual credit limit for the actual energy saving home improvements you make. You can search the internet for a qualified auditor in your area.

For home energy audits in 2024 or a later year, you will need to substantiate that a qualified auditor conducted your home audit. To satisfy this requirement, the written audit should state that the auditor is certified by one of the certification programs listed on the Department of Energy certification programs for the Energy Efficient Home Improvement Credit page to conduct the home energy audit.

When making an energy saving home improvement that qualifies for a credit, keep in mind there are credit limits that you must consider to maximize your annual credit:

- The annual credit limit is $1,200. So, it may be appropriate to plan your home energy improvements over multiple years to maximize the tax credit.

- The improvement costs also have limits based on the category of the improvement. For example: Assume an energy efficient exterior window is one of your improvements and it costs $1,000. The credit allowable expense for an exterior window is only $600. Thus, the allowable credit for that window expense would be $180 (30% of $600).

- The credit is non-refundable, meaning it can only reduce your tax liability to zero and there is no carryover of unused credits to a subsequent year. However, don’t confuse that with the fact that you are reducing your overall tax. You can be receiving the benefit of the credit and still have a tax liability.

The caps and categories of improvements under the annual $1,200 limitations are as follows:

- $600 for any item of qualified energy property, that generally includes (this is not a complete list which only includes the more common improvements):

o An electric or natural gas heat pump water heater.

o An electric or natural gas heat pump.

o A central air conditioner.

o A natural gas, propane, or oil water heater, and

o A natural gas, propane, or oil furnace or hot water boiler. - $600 for exterior windows and skylights,

- $250 for any single exterior door and $500 in the aggregate for all exterior doors.

Not subject to the annual $1,200 limit or the $600 per item limit and instead subject an aggregate annual limit of $2,000 are:

- heat pumps,

- heat pump water heaters,

- biomass stoves, and

- biomass boilers

The tax code sets out the requirements that must be met for the energy property to qualify for the credit. A few examples: exterior doors must meet Energy Star requirements, windows and skylights must meet Energy Star most efficient certification requirements, and electric or natural gas water heaters must meet or exceed the highest efficiency tier (not including any advanced tier) established by the Consortium for Energy Efficiency (list available at CEE Directory | AHRI (ahrinet.org)) that is in effect as of the beginning of the year in which the property is placed in service A home energy auditor or the seller/installer of the property should be able to provide you with the details. Be sure to ask for and retain written material that confirms the energy property qualifies for the credit. . .just in case the IRS wants proof of eligibility.

Please contact this office for more information about qualifying improvements and assistance in timing your energy efficiency improvements to maximize the tax benefits.

Business Succession Planning

The Importance of Business Succession Planning

Every business – large and small – needs a business succession plan. Just like Warren Buffett and Jeff Bezos prepared for the day that they would step away from the C-suite, every small and mid-sized business owner should plan ahead so that the transfer of the leadership and/or ownership of their businesses will be smooth and effective, whether a sudden change requires it or a planned change occurs.

The Main Issues

The main issues addressed by business succession planning relate to people and money.

The People Aspect

The people aspect deals with ensuring that the most qualified individuals are ready to take leadership roles when needed.

With large corporations, a select pool of talent is generally available to take the reins when a CEO steps down. The Board of Directors and CEO will identify the people from within the company they believe are best qualified to assume top leadership roles. Industry leaders in the same or related industries can be added to the list so that the best talent will take charge of the company after a change.

With small to mid-sized companies, the decision might not be so easy. As the hit TV show “Succession” demonstrates, there are often several people who consider themselves to be viable successors but, often, there are none who possess all the characteristics required to run the company. This can be especially true with family-run and other closely-held businesses. For example, if a business owner has three children running different aspects of the business, which one has the experience and character to lead the company into the future when the parent leaves the company? How will the siblings respond to this choice? Will they stay with the company and focus on its continued success or will they leave for a different challenge? How does the current owner incentivize each of them so that they see the benefit of staying with the company after the parent has left? The longer the issue remains undecided or unannounced, the greater the stress on all the parties and the business. Once a successor is announced, the owner can more freely share his or her knowledge with the designated individual so that the company can continue forward after the leadership change without missing a beat.

The Money Aspect

While the people aspect is key to always having talented leadership in place, the money aspect of a change in ownership can also endanger the future of a business. This is not an issue with a corporation – especially when its stock is widely held. The outgoing leader often retains his or her stock but can also sell, gift, or otherwise transfer his or her shares. In most cases, what the outgoing leader does with his or her stock is inconsequential to the company’s future.

With a partnership, however, a partner’s exit can dissolve the partnership or require a restructuring and/or refinancing of the business. If the outgoing partner has died, the disposition of his or her interest in the partnership must be addressed in one way or another. It’s important to have a written partnership agreement that specifies what is to happen when a partner leaves.

Cross-Purchase Agreements

Insurance is one way to prepare for a partner’s exit. With cross-purchase agreements, the partners buy and own insurance policies on one another so that, if one partner dies, the remaining partners have the funds to buy out his or her interest at a previously-set price. The value of the insurance policies is based on the value of each partner’s interest. This is calculated by dividing the value of the business – preferably determined by a qualified appraisal – by the number of partners (or multiplying by their respective percentage interests if not equal). The insurance coverage is then equal to the value of the partner’s interest divided by the number of remaining partners (or multiplied by their ownership percentages if not equal). For example, if there are 5 equal partners and the business is valued at $6 million, the value of each partner’s interest is $1.2 million. Each partner would purchase an insurance policy on each of the other partners with a face value of $300,000. If one partner dies, the others would then have $1.2 million in insurance proceeds (4 remaining partners times $300,000) to buy out the deceased partner’s $1.2 million interest. Valuation of the business should be redetermined periodically so that the amount of the insurance coverage can be adjusted when needed.

Entity-Purchase Agreements

When a cross-purchase agreement is not practical (such as when there are many partners or there are large age differences between the partners), the business itself can purchase insurance on the life of each partner in order to buy out an exiting partner’s interest. The business is the policy owner and the beneficiary. Entity-purchase agreements reduce the complexity inherent in some cross-purchase agreements and the insurance premiums may be deductible by the business.

Sales, Gifts and Inheritances

Sole proprietors and corporate shareholders can transfer a full or partial interest in the business by sale, gift or inheritance. Partners cannot make the same transfers freely. In fact, an attempt to transfer a partnership interest can dissolve the partnership. This disparity in transfer options recognizes the unique relationship between partners and protects them from being forced to accept a new person or entity with whom they might not want to partner.

With a partnership, the partners share the management of the business. Changing even one partner can significantly alter the business dynamic that the partners have created. Thus, one partner cannot freely thrust a new partner into the mix without the other partners’ consent. This is one reason why partnerships often rely on cross-purchase and entity-purchase agreements to ensure the ongoing viability of the enterprise. They allow a partner to exit without delivering a death blow to the business if the other partners are not otherwise financially positioned to purchase the outgoing partner’s interest and/or they do not agree on a new partner to replace the exiting partner.

Stock transfers don’t present the same issue. If a controlling shareholder sells their stock, this doesn’t change the ability of the minority shareholders to impact the direction of the business. They didn’t have the power to influence decision-making to begin with. If they do not like the direction that the company is taking, they are usually free to sell their stock without impacting the relationship between the company and the other owners. Thus, corporate owners are generally free to sell, gift, or bequeath their interest in a business without the consent or involvement of the other stockholders.

Sole proprietors are limited to either selling the business outright or changing the ownership structure of the business to add a new owner. If a sole proprietor brings a new owner into the mix, this would create a partnership with or without a written agreement. If a written agreement is signed, it can take the form of a general partnership, limited partnership, or limited liability partnership. The written agreement will dictate the terms of the relationship and the ways in which an ownership interest could be transferred. If the business is incorporated stock is issued and can be transferred subject to the company’s stock transfer rules.

Summary

Business succession plans are most effective when they address the short- and long-term interests of the business and its owner(s). Taking people and money aspects into account is key to creating an effective plan.

With large corporations, the people aspect involves identifying top leadership replacements for the short- and long-term. The people aspect is similar for small and mid-sized businesses – with a twist since the owner’s family and/or close associates are involved.

Partnerships add a money aspect that is best addressed by purchasing insurance policies on the lives of the partners to help the remaining partners buy out an exiting partner’s interest. These policies can be purchased by the partners or by the partnership itself.

In all cases, there must be a short-term plan for dealing with unexpected events and a long-term plan that lays the groundwork for the company to continue to thrive from generation to generation. Better to prepare today than to be forced to pivot tomorrow.

If you are developing your business succession plan, we can help you review the tax aspects in advance. Please call for assistance.

Employee Spotlight: Mary McClain

A new member of the Ross Buehler Falk & Company (RBF) team, Mary McClain came on board in 2023 and serves as the firm’s small business specialist. Her work focuses on bookkeeping and assisting companies with their daily needs. An administrative professional with over 30 years of experience, Mary combines excellent time management, organizational skills, and an eye for detail to provide superior service to her clients.

Mary’s personal service philosophy is “Listen with your ears, not your mouth,” a motto that helps her build authentic relationships. She holds a bachelor’s in marketing from Penn State University. Prior to joining the RBF team, Mary worked in office management and bookkeeping and, notably, served as the business manager of Meadia Heights Golf Club for ten years.

Mary lives in her hometown of Lancaster, Pennsylvania, with her husband David, their two sons, Patrick and Stewart, and a cat named Summer.

Want to get to know Mary even better? Here are a few fun facts about her:

- Being a mother to her sons has been the biggest reward in Mary’s life. She feels blessed to be able to balance her work life with her Full-Time Job (Mom). She loves to watch them play Lacrosse!

- When it comes to a favorite author, Mary can’t choose between Jon Gordon & Karen Kingsberry. She loves them both equally.

- The last thing she binge-watched was the series Yellowstone.

- When you get into Mary’s car, the radio will probably be tuned to a country station.

- She loves cheering for her alma mater Penn State football.

- Mary’s ideal vacation destination is anywhere with a beach.

Stronger Regulations Coming for Taxes on Cryptocurrency

The nature of innovation means that laws will always be lagging behind new technology, now, legislation is attempting to catch up to cryptocurrency.

Approximately 17% of US adults have used digital currency, which positions itself as a decentralized method of payment. But as marketplaces have grown, they have quickly created a landscape that makes it easy for users to avoid paying taxes owed to the government.

A new tax form proposed by the Treasury Department in August, called Form 1099-DA, would make it easier for the government to determine which taxpayers owe money from crypto transactions, it would also help give crypto users a more straightforward way to determine what they owe. The proposed changes are an attempt to enforce legislation adopted by Congress in 2021 with the passage of the Infrastructure Investment and Jobs Act.

How Paying Taxes on Cryptocurrency is Changing

Currently, paying taxes on crypto transactions largely relies on the honor system. Because these platforms were designed without the intention of operating like traditional financial institutions, there is little in place to facilitate the enforcement of tax law. And even when users do pay taxes, without a formal report, it is often difficult to accurately determine what they owe.

The proposed Form 1099-DA would require that brokers annually report the sales and exchanges of digital assets by their users to both the IRS and the taxpayer. This would bring reporting for cryptocurrency more in line with requirements for traditional brokers.

Who will Be Affected?

The new rules are intended to bring enforcement to a still rapidly growing industry and will affect cryptocurrencies such as Bitcoin, Litecoin and more, as well as non-fungible tokens (NFTs). The proposal defines “brokers” as either centralized or decentralized digital trading platforms, crypto payment processors, and online applications for storing digital assets.

The challenge will come in compliance and enforcement. Even if crypto brokers fully cooperate, these platforms lack the infrastructure that stricter reporting requires. In addition to systemic upgrade, transparency will also need to be increased, as currently some platforms only require that traders disclose a username, making it impossible to know who they are offline.

What is Next for Crypto Users?

It is clear that the government is coming with stricter rules for the cryptocurrency market. The IRS will be accepting feedback on the proposal until October 30th, and if fully implemented, the reporting will begin in the 2025 tax year.

While details are still developing, one thing is certain, with stronger rules and enforcement comes stiffer penalties. Cryptocurrency users should prepare now to ensure they remain in compliance with new regulations. If you have any questions about tax implications or any other concerns regarding digital currency transactions, please reach out to your advisors at FIRM.

Sources:

- https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

- https://www.irs.gov/newsroom/treasury-and-irs-issue-proposed-regulations-on-reporting-by-brokers-for-sales-or-exchanges-of-digital-assets-new-steps-designed-to-end-confusion-help-taxpayers-aid-high-income-compliance-work

- https://www.axios.com/2022/04/19/crypto-taxes-remains-confusing-lack-irs-guidance

Employee Retention Credit Paused Amid Growing Fraud Concerns

The Internal Revenue Service (IRS) has announced a moratorium on new claims related to the pandemic-era Employee Retention Credit (ERC, also known as Employee Retention Tax Credit). The pause on new claims goes into effect immediately and will last until at least 2024.

When claimed properly, the ERC is a refundable tax credit designed to help employers who continued to pay their employees while their businesses were fully or partially suspended during the COVID-19 pandemic.

The move was prompted by growing concerns over fraud and abuse in the program resulting from scammers aggressively marketing the credit to honest small businesses. Currently, there are hundreds of criminal cases being investigated, with thousands more claims waiting to be audited.

What Is Next for Your ERC Claim?

Previously submitted claims will still be reviewed and paid out, however, at a much slower rate. Expected processing times will double from 90 days to 180 days, with the potential for an even longer timeline if the IRS must request additional documentation to substantiate the claim.

If you have submitted or received an ERC claim, here is what you should do next:

- If you have previously submitted a claim, it will still be processed, but you should be prepared for much longer wait times and increased scrutiny.

- If you have a pending claim, you are strongly encouraged to review it with a trusted tax advisor to confirm its validity and withdraw any claims that are determined to have been submitted improperly to protect yourself against potential repercussions such as fees and interest.

- If you have previously received an ERC in error, there will be guidance forthcoming on how to repay improper claims. There is a settlement program being developed to help businesses who applied in good faith to avoid penalties. More information is expected to be forthcoming this fall.

Protect Your Business Against Fraud

In its release, the IRS emphasized its priority of protecting honest businesses and taxpayers from those seeking to take advantage.

The IRS has also shared a list of warning signs that businesses should watch out for to protect themselves against aggressive marketers.

Conclusion

Businesses are encouraged to review their claims now to avoid negative impacts, including fines and fees. IRS commissioner Danny Werfel advised seeking the guidance of reputable advisors, saying, “businesses should seek out a trusted tax professional who actually understands the complex ERC rules, not a promoter or marketer hustling to get a hefty contingency fee.”

The tax professionals at Ross Buehler Falk & Company have the knowledge to help protect your business, please reach out today with any questions related to your ERC claims.

Sources:

Employee Spotlight: Kaitlyn McPeak

Kaitlyn McPeak joined the Ross Buehler Falk & Company (RBF) team in 2023 as an administrative assistant. She helps keep the office running smoothly, assisting with administrative tasks, including scheduling appointments, assembling tax returns and extensions, and e-filing. Her easy-going personality shines through as she greets clients when they call or visit the office.

Originally from Denver, PA, Kaitlyn recently moved to Loganville, PA, with her spouse, Alex; daughter, Olive; and a whole bunch of animals—two dogs named Peach and Coheed, a rabbit named Mumford, Heimdel the goose, a runner duck named Bellybutton, and five hens. Her favorite thing about her new town is visiting Perrydell Farm and Dairy, a working dairy farm that also sells homemade ice cream. In her free time, she enjoys reading, going for walks, and seeking out fun new experiences with her toddler.

Want to get to know Kaitlyn even better? Here are a few fun facts about her:

- The last show she binge-watched on Netflix was Better Call Saul.

- Her favorite book is Cat’s Eye by Margaret Atwood. She enjoys the imagery of the Canadian landscape and how the book makes her think about psychology.

- When she’s able to travel, Kaitlyn enjoys visiting Disneyworld or the Finger Lakes in New York State.

- Kaitlyn is a football fan, and on Sundays during the season, you can find her cheering for the New England Patriots.

- She loves to listen to local Lancaster station 96.1 SOX on her commute. She’s even been SOX’s Smartest Listener three times!

- Kaitlyn has an artistic side – one of her hobbies is acrylic and watercolor painting.

How Do You Move Transactions from Your Bank into QuickBooks Online?

Manual transaction entry doesn’t make sense anymore – not when QuickBooks Online makes the process of importing them from your bank so easy. If you enter them on your own, you risk data transposition errors, which can create inaccuracies in your customer billing, reports, and income taxes. Plus, it takes an inordinate amount of time that you could use in running other areas of your business.

If you’re still using a manual method, we suggest you consider setting up connections to your online banks. Once your transactions are delivered to QuickBooks Online, the site provides tools that allow you to view them and make sure they’re complete before you store them. Whenever you need to see them, you’ll be able to find them easily.

Here are step-by-step instructions to how this all works.

Making a Connection

In order to do this, you’ll of course need to have set up a username and password for your online bank accounts if you haven’t done so already. In QuickBooks Online, click Bookkeeping in the navigation toolbar. It should open to Transactions | Bank transactions. Click Link account over to the right.

A page opens with suggested financial institutions. If yours isn’t there, enter it in the search field at the top. If there are multiple options, be sure to select the correct one and click it.

If your bank isn’t listed on the page of options, enter its name, and then click on the correct one if there’s more than one entry.

Click Continue and go through any of the security steps your financial institution may have. You’ll get to a page that says, Which accounts do you want to connect?, with a drop-down list displaying options from your Chart of Accounts. Select the type of account you’re creating (checking, credit card, etc.) and continue to follow the onscreen instructions until your connection is complete and QuickBooks Online has downloaded your transactions.

WARNING: It’s important that you set up your linked accounts correctly since you’re dealing with the Chart of Accounts. If any step is confusing, we can schedule a session to go over online account connections with you.

Dealing with Transactions

Once you’ve connected to all your online accounts, you’ll see that they appear on the Bank transactions page, displayed in small boxes containing their balances and the number of transactions they contain (there might be quite a few when you first download). You can also see how recently each account was updated (click Update anytime you want to refresh an account).

Once you’ve connected to an online bank account, you can see how many transactions were downloaded and what its balance is.

Click one, and its register will appear below. Above that, you’ll see three labeled bars:

- For review. QuickBooks Online puts all downloaded transactions in this list.

- Categorized. Your transactions will move to this list after you’ve assigned categories to them.

- Excluded. If you happen to run into duplicate transactions, you can move them here.

Below that, you’ll see that you can filter your transactions by date, by type, or by description, check number, or amount.

WARNING: As you continue to work with accounts, you may occasionally find that a connection has been unlinked. When that happens, just repeat the connection process again.

Working with Individual Transactions

You’ll want to set some time aside the first time you download transactions so you can look at each one and add or edit its content. Click one to open its detail box, as shown below. The top line defaults to Categorize. First, select the correct Vendor/Customer (or + Add new), then check the Category and change it from the drop-down menu if it’s incorrect.

You can add or edit a lot of details for your individual transactions.

There’s one more field here that’s very important. If you’re purchased something on behalf of a customer, be sure to select the correct one from the drop-down list under the Customer field and click the Billable box. QuickBooks Online will make this transaction information available to you the next time you invoice the customer. Other fields not shown in the above image are optional, like Tags, Memo, and Add attachment. When your transaction is complete, click Confirm to move it to the Categorized list.

There are two other options in these individual transaction boxes besides Categorize: Find match (match downloaded payments to invoices, for example) and Record as transfer (move money from one account to another). These are advanced topics that aren’t necessarily intuitive, so we can schedule a session to go over them if you anticipate needing to use them.

The mechanics of connecting to your banks in QuickBooks Online aren’t complicated, but you may run into problems in moving transactions along when they’re first downloaded. Let us know if we can help here. It’s much easier to get it right from the start than to try to untangle transactions that weren’t processed properly.

Are You Ignoring Retirement?

Are you ignoring your future retirement needs? That tends to happen when you are younger, retirement is far in the future, and you believe you have plenty of time to save for it. Some people ignore the issue until late in life and then have to scramble at the last minute to fund their retirement. Others even ignore the issue altogether, thinking their Social Security income (assuming they qualify for it) will take care of their retirement needs.

By current 2023 government standards, a single individual with $14,580 or a married couple with $19,720 of annual household income is at the 100% poverty level. If you compare those levels with potential Social Security income, you may find that expecting to retire on just Social Security income may result in a bleak retirement.

You can predict your future Social Security income by visiting the Social Security Administration’s Retirement Estimator. With the Retirement Estimator, you can plug in some basic information to get an instant, personalized estimate of your future benefits. Different life choices can alter the course of your future, so try out different scenarios – such as higher and lower future earnings amounts and various retirement dates – to get a good idea of how these scenarios can change your future benefit amounts. Once you’ve done this, consider what your retirement would be like with only Social Security income.

If you are fortunate enough to have an employer-, union- or government-funded retirement plan, determine how much you can expect to receive when you retire. Add that amount to any Social Security benefits you are entitled to and then consider what retirement would be like with that combined income. If this result portends an austere retirement, know that the sooner you start saving for retirement, the better off you will be.

With unsteady interest rates and an up-and-down stock market, it is much more difficult to grow a retirement plan with earnings than it was 10 or 20 years ago. While current interest rates are higher than they’ve been in the past few years, they barely mirror inflation rates, so there is little or no effective growth. That means one must set aside more of one’s current earnings for retirement to prepare for a comfortable retirement.

Because the government wants you to save and prepare for your own retirement, tax laws offer a variety of tax incentives for retirement savings plans, both for wage earners and for self-employed individuals and their employees. The contribution limits vary each year and the amounts shown in this article are for 2023. These plans include:

- Traditional IRA – This plan allows up to $6,500 (or $7,500 for individuals age 50 and over) of tax-deductible contributions each year. The extra contribution, sometimes referred to as a catch-up contribution, allowed for those age 50 and over will be inflation-adjusted starting with 2024. However, the amount that can be deducted phases out for higher-income taxpayers who also have retirement plans through their employer.

- Roth IRA – This plan also allows up to $6,500 (or $7,500 for individuals age 50 and over) of contributions each year. The catch-up contribution amount will also be inflation adjusted after 2023. Like the Traditional IRA, the amount that can be contributed phases out for higher-income taxpayers; unlike the Traditional IRA, these amounts phase out even for those who do not have an employer-related retirement plan.

- Employer 401(k) Plans – An employer 401(k) plan generally enables employees to contribute up to $22,500 per year, before taxes. In addition, taxpayers who are age 50 and over can contribute an extra $7,500 annually, for a total of $30,000. Starting in 2025, the catch-up amounts will be increased for employees ages 60 through 63, and as of 2024 catch-up contributions by employees with wages over $145,000 will need to be made to a Roth-style plan. Many employers also match a percentage of the employee’s contribution, and this can amount to a significant sum for those who stay in the plan for many years.

- Health Savings Accounts – Although established to help individuals with high-deductible health insurance plans pay medical expenses, these accounts can also be used as supplemental retirement plans if an individual has already maxed out his or her contributions to other types of plans. Annual contributions for these plans can be as much as $3,850 for individuals and $7,750 for families.

- Tax Sheltered Annuities – These retirement accounts are for employees of public schools and certain tax-exempt organizations; they enable employees to make annual tax-deferred contributions of up to $22,500 (or $30,000 for those age 50 and over).

- Self-Employed Retirement Plans – These plans, also referred to as Keogh plans, allow self-employed individuals to contribute 25% of their net business profits to their retirement plans. The contributions are pre-tax (which means that they reduce the individual’s taxable net profits), so the actual amount that can be contributed is 20% of the net profits.

- Simplified Employee Pension (SEP) – This type of plan allows contributions in the same amounts as allowed for self-employed retirement plans, except that the retirement contributions are held in an IRA account under the control of the employee or self-employed individual. These accounts can be established after the end of the year, and contributions can be made for the prior year.

- Saver’s Credit – In the case of low-income taxpayers, the government provides a tax credit of as much as 50% of the first $2,000 of the individual’s qualified retirement savings contributions. This credit won’t apply after 2025 but is being replaced by a “savings match” where the government will match up to 50% of the first $2,000 contribution to retirement plans and IRAs for lower-income taxpayers.

Each individual’s financial resources, family obligations, health, life expectancy, and retirement expectations will vary greatly, and there is no one-size-fits-all retirement savings strategy for everyone. Purchasing a home and putting children through college are examples of events that can limit an individual’s or family’s ability to make retirement contributions; these events must be accounted for in any retirement planning, as do the continual changes provided by Congress to the retirement plan tax benefits and rules.

If you have questions about any of the retirement vehicles discussed above, please give this office a call.