Categories for

Too Many Transactions in QuickBooks Online? Create Rules

One of the cardinal rules of accounting is this: Go through your new transactions every day. If you wait until there are too many of them, you’re likely to give them short shrift. You may miss problems, just as you might skip categorizing some of them because it simply takes too long.

But correct categorization is essential. Your income taxes and reports will not be accurate if you fail to assign the right category to all of your transactions. QuickBooks Online makes this easy.

The site also provides a way for you to accelerate the process by automating it. It allows you to create Rules. That is, if a transaction contains a specific piece of information, a name or an amount, QuickBooks Online allows you to indicate how it should be categorized. This kind of automation will save you time and may even prevent errors – as long as you use it carefully. Here’s how it works.

Defining Your Rules

We’ll use an easy example to explain how QuickBooks Online’s Rules work. Let’s say your shipping costs have started to increase lately, and you want to make sure you’re seeing any UPS transactions that go above a specified dollar amount, and that they’re categorized accurately. Hover your mouse over Transactions in the toolbar and click on Banking (assuming you’re downloading your bank transactions). Select an account to work with by clicking on it, and make sure the For review bar is highlighted.

Click on a transaction to open it. (If you’ve never explored what you can do with a downloaded transaction, study this box carefully while you’re there, and contact us with any questions.) On the bottom line, you’ll see a link labeled. Create a rule. Click on it, and a panel slides out from the right, as pictured below:

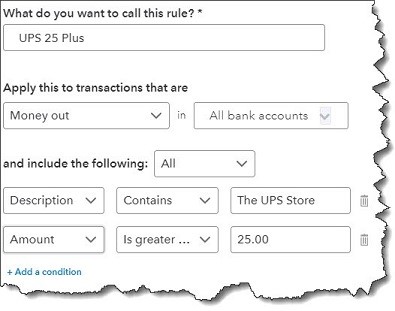

The upper half of the Create rule panel

This portion of the Create rule panel is fairly self-explanatory. Give your rule a descriptive name (we entered UPS 25 Plus), and indicate whether it should be applied to Money in or Money out. If you want to select a specific bank account or card, click the down arrow in the field to the right and select it. Otherwise, choose All bank accounts. Next, decide whether a transaction has to meet Any of the conditions you’re going to specify or All of them. In this case, we want All.

Now you have to describe the conditions under which a transaction will be affected. We want transactions whose Description Contains The UPS Store. We also want to identify purchases from The UPS Store whose total is more than $25. So you’d click + Add a condition. In the row that opens, click the down arrow in the Description field and select Amount. Click the down arrow again in the next field and choose Is greater than. The final field in the row should contain 25.00.

You could keep adding conditions, but that’s all we need for this rule. You can click Test rule if you want to find out how many transactions in your For review list would meet your specifications.

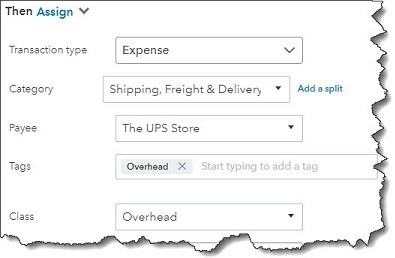

Next, you want to Assign attributes to the transactions selected. Your options here are Transaction type, Category, Payee, Tags, Class, and Memo. The first two are required and the third is recommended. The last three are optional. If you want QuickBooks Online to automatically confirm transactions this rule applies to, click the Auto-confirm button so it’s showing green. If you choose this option, your matching transactions will be modified to meet your criteria and moved directly into the Categorized queue. You won’t see them in For review. So consider this carefully.

When you’re done here, click Save.

The lower half of the Create rule screen

Warning: QuickBooks Online allows you to create new categories directly from this window. But accurate categorization is so critical that we’d rather you schedule a session with us to go over your list of categories and make any modifications necessary.

To recap: Any expense over $25 that comes into your For review queue whose Description reads The UPS Store will be automatically categorized and moved into the Categorized queue.

QuickBooks Online’s Rules can save you time, but if they’re not created correctly, you may have errors in your company file without even knowing it. We recommend that you let us help you set these up from the start to avoid this. If you’re new to downloading transactions onto the site, you may also want to consult with us.

Owe the IRS Money? How Long Do They Have to Collect?

Have you ever wondered how long the IRS has to question and assess additional tax on your tax returns? For most taxpayers who reported all their income, the IRS has three years from the date of filing the returns to examine them. This period is termed the statute of limitations. But wait – as in all things taxes, it is not that clean cut. Here are some complications:

You file before the April due date – If you file before the April due date, the three-year statute of limitations still begins on the April due date. So filing early does not start an earlier running of the statute of limitations. For example, whether you file your 2021 return on February 15, 2022, or April 15, 2022, the statute does not start running until April 18, 2022 (that’s not a typo). The due date for 2021 returns was delayed from April 15 to April 18 because of a holiday in the District of Columbia (Emancipation Day) and a weekend, and the April 18th date applies even if you don’t live in DC. But there’s a further exception for residents of Massachusetts and Maine, the due date for 2021 returns is April 19, 2022, because of a holiday observed in both of those states. So, for residents in these two states, the statute of limitations for 2021 returns begins on the 19th.

You may recall that due to the Covid-19 pandemic, the IRS extended the original due date to May 17, 2021 for 2020 returns and to July 15, 2020 for 2019 returns. As a result, the statute of limitations for refunds expires May 17, 2024 for 2020 returns and July 15, 2023 for 2019 returns.

You file after the April due date – The assessment period for a late-filed return starts on the day after the actual filing, whether the lateness is due to a taxpayer’s delinquency, or under a filing extension granted by IRS. For example, say your 2021 return is on extension until October 17, 2022, and you file on September 1, 2022. The statute of limitations for further assessments by the IRS will end on September 2, 2025. So the earlier you file those extension returns, the sooner you start the running of the statute of limitations.

If you want to be cautious you may wish to retain verification of when the return was filed. For electronically filed returns, you can retain the confirmation from the IRS accepting the electronically filed return. If you file a paper return, proof of mailing can be obtained from the post office at the time you mail the return.

You file an amended tax return – If after filing an original tax return you subsequently discover you made an error, an amended return is used to make the correction to the original. The filing of the amended tax return does not extend the statute of limitation unless the amended return is filed within 60 days before the limitations period expires. If that occurs, the IRS generally has 60 days from the receipt of the return to assess additional tax.

You understated your income by more than 25% – When a taxpayer underreports their gross income by more than 25%, the three-year statute of limitations is increased to six years.

In determining if more than 25% of income has been omitted, capital gains and losses aren’t netted; only gains are taken into account. These “omissions” don’t include amounts for which adequate information is given on the return or attached statements. For this purpose, gross income, as it relates to a trade or business, means the total of the amounts received or accrued from the sale of goods or services, without reduction for the cost of those goods or services.

You file three years late – Suppose you procrastinate and you file your return three years or more after the April due date for that return. If you owe money, you will have to pay what you owe plus interest and late filing and late payment penalties. If you have a refund due, you will forfeit that refund and perhaps get stuck with a $450 or more minimum late filing penalty (the amount is adjusted for inflation each year). No refunds are issued three years after the filing due date.

You haven’t filed at all – In situations where no tax return has been filed or there’s fraud (the willful intent to evade tax), there is no time limit for the IRS to assess the tax or additional tax or to take court action.

10-year collection period – Once an assessment of tax has been made within the statutory period, the IRS may collect the tax by levy or court proceeding started within 10 years after the assessment or within any period for collection agreed upon by the taxpayer and the IRS before the expiration of the 10-year period.

Discarding tax records – Remember not to discard your tax records until after the statute has run its course. When disposing of old tax records, be careful not to discard records that prove the cost of items that have not been sold. For example, you may have placed home improvement records in with your annual receipts for the year the improvement was made. You don’t want to discard those records until the statute runs out for the year you sold the home. The same applies to purchase records for stocks, bonds, reinvested dividends, business assets, or anything you will sell in the future and need to prove the cost.

And a word of caution about discarding those tax records – to limit your exposure to ID theft, be sure to dispose of the documents safely and securely, such as by shredding paper files, or if the records are stored on your computer delete them, or by destroying the hard drive when you take the device out of service.

State statute of limitation – Most, but not all, states follow the federal 3-year statute of limitations and 10-year collection period rules. Contact this office if you need further information about your state’s statute of limitations.

If you are behind on filing your returns and would like to get caught up, please give our office a call. If you discovered you omitted something from your original return and would like to file an amended return, we can help with that as well.

Why Employee Classification is of Paramount Importance

Not too long ago in Orlando, Florida, a federal investigation uncovered a situation where 22 workers were denied overtime by a Florida-based equipment rental company. The company was paying flat salaries to certain employees, regardless of how many hours they worked in a given week. It was revealed that they were doing this in an attempt to skirt the overtime requirement of the Fair Labor and Standards Act.

The rental company quickly learned that just because you pay someone a salary doesn’t mean you can avoid these types of laws. The government recovered $122,000 in back wages and damages for those employees as a result of this improper classification of their employment status.

Why Employee Classification Matters

Situations like these highlight the importance of classifying employees correctly from the start. Whenever this topic comes up, most people think about the differences between independent contractors and actual workers employed by a business. But as you can see from the example above, there are many other parts to this discussion as well.

Ultimately, it all comes down to the difference between salary and hourly pay employees. Salaried employees are typically those who receive a specific wage, with the understanding that they are going to keep up with all of their stated responsibilities. Sometimes, this means working more than 40 hours a week in exchange for that salary.

Hourly employees are treated a bit differently, however. Here, the expectation is that they will work a standard 40 hours per week, every week, except for any vacation time they may have accrued. In the event that a project or responsibility takes them over 40 hours per week, they are entitled to time and a half for each hour they go beyond.

There are a few major reasons why someone might prefer a salaried position over an hourly one. No, they aren’t going to receive overtime pay like their hourly employees – but they do have access to certain benefits that their counterparts don’t.

A salaried employee gets a check for the same amount of money each payday. This makes it far easier to budget than if their hours were uncertain. Provided that they keep up with their duties, that number will not change throughout the year. Being salaried also comes with a certain sense of security because while employers may cut someone’s hours, that salary is still more or less locked into place.

Hourly employees are equally as straightforward but in a different way. In an hourly position, you are paid for all of the hours you work – no more, no less. Overtime and things like holiday pay are certainly a bonus and can help people earn extra income.

Being an hourly employee does also lack the job security that a salaried position comes with. You may not outright lose your position, but an employer could significantly cut back on hours – impacting your take-home pay as well.

There are, however, certain situations where salaried employees will get overtime – as that organization in Florida recently had to learn the hard way. Unless a salaried employee is completing a task that is exempted, they must receive overtime pay if they are covered by the FLSA. According to the FLSA, some job categories that are considered exempt include those operating in professional capacities, in administrative roles, executives, outside sales personnel, and computer-related positions.

In the end, it’s more important than ever to properly classify the employment status of your workers – if only to avoid a potentially catastrophic situation later on (like via a run-in with the federal government).

Inheritances Enjoy a Special Tax Benefit

You may hear people use the term “Stepped-Up Basis” that many believe is a tax provision that allows beneficiaries of an inheritance to reduce or even avoid taxes when and if they sell inherited property.

When an individual sells property, any gain from the sale of the property is taxable. The tax term “basis” is the value from which any taxable gain is measured. For personal use property or investment property the basis is generally the cost of the property. For business property the term basis is replaced with adjusted basis, which generally means the cost of the property reduced by business deductions, such as depreciation, attributable to the property.

However, for property received as a beneficiary the term inherited basis used. Tax law specifies that property received by a beneficiary as a result of an inheritance is the fair market value (FMV) of the property as of the decedent’s date of death. Since some property, such as real estate, generally appreciates over time, that means the property’s value will have increased, and the FMV on the date the decedent died will be higher than the decedent’s basis. Thus, the beneficiaries will inherit the property with a basis higher than the decedent’s, so they will have a stepped-up basis.

Example: Jack has owned a rental property for several years. He purchased it for $200,000 and over the years claimed a depreciation deduction of $24,000 up to the time of his death. Thus, his basis when he passed away was $176,000 ($200,000 – $24,000). At the time of Jack’s death, the rental had an appraised FMV of $400,000. Bill, Jack’s only beneficiary, will have a basis of $400,000, and if he immediately sells the rental for $400,000, he would not have a taxable gain. On the other hand, had Jack sold the property for $400,000 just before his death he would have had taxable gain of $224,000 ($400,000 – $176,000). (Sales expenses have been disregarded in this example.)

The example demonstrates the value of a beneficiary receiving a “stepped-up” basis. However, the actual term used in tax law is that the beneficiary receives the FMV at the date of the decedent’s death, so it is not always a stepped-up basis; there could be a step down in basis.

Another tax benefit of an inheritance is that a gain from the sale of inherited property is treated as being held long-term and gets the benefit from the lower long-term capital gain tax rates even though the property is not held by the beneficiary over one year.

Spousal Inheritances – Where spouses jointly own property a surviving spouse will sometimes only inherit half of the property since they already owned half, and thus only receive a basis adjustment on the inherited portion of a property. However, where the spouses live in a community property state, and the property is held as community property, the surviving spouse will get a basis reset to the FMV of the property for both the deceased spouse’s half they inherited and their own half.

Jointly Owned Property – Where two or more individuals own property as joint tenants and the joint tenants inherit a portion of the property from a deceased joint tenant, the beneficiary joint tenants only receive a basis adjustment on the inherited portion of the property.

In the case of inherited business property or rentals, a frequently asked question is what becomes of the accumulated depreciation on the inherited portion of jointly owned property? This is another benefit of inheritances as the accumulated depreciation goes away and the beneficiary, if using the inherited property for business purposes or as a rental, simply restarts the depreciation from scratch on the inherited portion.

Gifting Prior to Death – Another issue is that some individuals choose to gift property prior to death. This is commonly encountered by elderly parents gifting a home or rental to their children. When an individual receives a gift of property, the individual’s basis becomes the same basis as the giver’s basis. Therefore, there is no step-up in basis as previously discussed. So, unless there is some other underlying issue, generally it is not a good idea tax wise to make large gifts of property.

Example: Mom is in her 80s and her home, which she purchased for $100,000, has a current value of $300,000. She gifts the home to her only child, Joe, while she is still living. For gifts the gift recipient’s basis becomes the giver’s basis, and in Mom’s case her basis was $100,000 which becomes Joe’s basis. As a result of the gift Joe has a $200,000 built in gain when and if he sells the home. If Joe had inherited his Mom’s home, his basis would have been $300,000 plus any additional appreciation before her death.

As you can see, our tax laws are complicated when it comes to inheritances and gifts. It is generally good practice to pre-plan for inheritances and gifting. Call for a tax planning appointment if you would like assistance.

Cash Flow Solution for Seniors

The annual inflation rate in the U.S. accelerated to 7.5% in January of 2022, the highest since February of 1982, hitting those on fixed retirement income, namely seniors, the hardest.

On top of escalating living expenses due to inflation, some retirees are faced with a significant amount of debt and inadequate income. Some seniors that have a mortgage on their home have retirement income too low to cover the mortgage payments and have enough left over to be able to enjoy their golden years. Are there any remedies for this situation?

One possibility for those who have built up equity in their primary (main) home is to obtain a “reverse mortgage,” as this type of mortgage considers the homeowner’s equity. The loan is not due until the homeowner passes away or moves out of the home. If the homeowner dies, the heirs can pay off the debt by selling the house, and any remaining equity goes to them. If at that time the loan balance is equal to or more than the value of the home, the repayment amount is limited to the home’s worth.

If the borrower is married and dies before their spouse, the surviving spouse must begin or continue to occupy the home as their primary residence to keep the reverse mortgage, and the surviving spouse will need to establish proof of their legal right to stay in the home. If the spouse isn’t named as a borrower on the reverse mortgage, the loan may be due upon the borrower’s death, even if the spouse continues to live in the home.

Only borrowers aged 62 years and over with equity in the home can qualify for a Federal Housing Administration-backed loan of this type. Some private lenders have a different age requirement. Since the reverse mortgage must be a first trust deed, any existing loans on the home must be paid off with separate funds or with the proceeds from the reverse mortgage. The amount that can be borrowed is based upon age – the older the borrower, the larger the reverse mortgage can be and the lower the interest rate. The loan amount will also depend on the value of the home, interest rates, and the amount of equity built up. Over time, the amount of the loan will increase as the deferred interest payments, loan fees not paid up-front, and servicing fees are added to the original loan amount.

The borrower has the option of taking the loan as a lump sum, a line of credit, or fixed monthly payments. In addition, the money generally can be used for any purpose, without restrictions imposed, so long as any prior mortgage on the home has been paid off.

To determine whether the interest on a reverse mortgage is tax-deductible, these factors are considered:

- Interest (regardless of type) is not deductible until paid. A reverse mortgage loan is not required to be repaid if the borrower lives in the home. Therefore, the interest on a reverse mortgage is not deductible by anyone until the loan is paid off.

- Unless there is an existing acquisition loan on the property, the reverse mortgage loan would be an equity debt and interest on equity debt is not currently deductible.

So, who deducts the interest when the loan is paid off?

Debtor – If the borrower pays off the loan while still living, the borrower, if itemizing deductions, is the one who deducts the sum of the interest they would have been entitled to deduct each year had it been paid, subject to the limitations discussed in 1 & 2 above.

Estate – After the borrower passes away and their estate pays off the loan, the estate would deduct the interest on its income tax return. The amount deductible would be the sum of the interest the borrower would have been entitled to deduct each year had the borrower paid it, subject to the limitations discussed in 1 & 2 above.

Beneficiary – If the beneficiary who inherits the home pays off the mortgage, the interest would be deductible as an itemized deduction on that individual’s personal 1040 income tax return for the payoff year. The amount deductible would be the sum of the interest the borrower would have been entitled to deduct each year had they paid it, subject to the limitations discussed in 1 & 2 above. If there is more than one beneficiary who pays off the mortgage, any beneficiaries who itemize deductions on their personal 1040s would be allowed to deduct their share of the allowable interest in proportion to the amount of the loan that each has paid off.

Reverse mortgages have brought financial security to many seniors so that they can live a comfortable life. If you are a senior who is struggling with your finances, carefully explore your options, including the possibility of a reverse mortgage. However, reverse mortgages should be approached with caution and other options explored first. For instance, some reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high, especially if you don’t plan to be in your home for a long time or only need to borrow a small amount. Also, since you remain the owner of the home, you continue to be responsible for paying property taxes, insurance, utilities, maintenance, and other expenses related to the home. Failing to pay these expenses could result in the lender requiring the reverse mortgage to be repaid.

If you would like to explore your options for increasing your cash flow or have questions about reverse mortgages, please give our office a call.

Give a College Savings 529 Plan For Graduation

If you want to make an impact in your new grad’s life, make an investment in his or her future with a 529 College Savings account. There are two versions: an investment account and a prepaid account. Assuming you are opening an account now and don’t have time for investment growth, you may need to fund it with a significant chunk of money for it to be useful. The savings plan is good for building an investment balance over time, including while the student is in college. On the other hand, the prepaid option is a good way to reinvest a windfall – such as an inheritance or proceeds from the sale of a property.

A 529 College Savings Plan allows the account owner to open and fund the account, choose the investments, and name the account beneficiary – while still retaining control of the assets. Be aware that contributions do not qualify for a federal tax deduction, but more than 30 states allow a limited tax deduction or credit. While earnings and withdrawals used for qualified education expenses are not taxed at the federal level, there are a handful of states that do impose state taxes.

However, because you – the giver – retain control of the account, you can be assured that the money won’t be wasted on a trip to Cancun or a gap year backpacking through Europe. You determine when, how much, and for what distributions are used. If you’re not happy with the student’s choices, you can change the beneficiary to someone else or keep it for yourself.

Gift Strategies for Retirees

There is generally no annual contribution limit to a 529 plan, but the total amount in a beneficiary’s account may not exceed the balance limit determined by each state. 529s are state-sponsored, but most states let non-residents open a plan. In addition, some states allow anyone who contributes to a 529 plan to take a state tax deduction. This way you also can invite friends and family to enjoy a tax deduction while contributing to the account for one big, combined graduation gift.

In 2022, you can contribute up to $16,000 per beneficiary ($32,000 per married couple) to a 529 plan without having to file a gift-tax return. However, if you want to stockpile the account for a big splash on graduation day, the IRS allows you to frontload up to five years’ donations in one year (up to $80,000; $160,000 for a married couple) outside the gift tax limit, although no other gifts can be made to the same beneficiary over the next five years. In this case, you must make the required election on a gift tax return that year to be allocated over five years. This five-year front-loading approach can be an effective estate planning strategy to remove assets from your taxable estate, yet retain control over them.

You also can maximize your gift by making it a two-for-one. In other words, gift it to your high school grad, then keep funding it during his university years. Any leftover balance can be his college graduation gift if he’s planning to go to law school or get an MBA. If not, you always have the option to keep the balance or gift it to him anyway – although proceeds not used for education expenses will be subject to taxes on earnings and a 10 percent penalty.

Student’s Choice

The 2019 SECURE Act enhanced the College 529 plan with additional options. Your new graduate can now use the money to pay for expenses associated with a registered apprenticeship program or use up to $10,000 to repay student loans. Note that if proceeds are used to pay student loans, the loan interest cannot be used as a deduction that tax year.

A 529 Plan gives your new graduate the option of how and when to use the funds. After all, the pandemic has thrown many young adults off course in different ways. Some are opting to go straight into the job market without a degree, while others are taking a gap year or two to get a feel for what type of career they want to pursue. With the College Savings investment plan, your contributions have the opportunity to grow tax-deferred indefinitely. Some states place time or age limits on the use of a prepaid plan. However, you can always retrieve unused assets from a 529 (subject to earnings and penalty taxes), so they are not lost by any means.

The 50/30/20 Budgeting Rule Explained

You may or may not have heard of the 50/30/20 budgeting rule, but it’s a good one — one that will help make organizing your finances a lot simpler. The basic idea is to divide up your after-tax income and allocate it for spending in this way: 50 percent on your needs, 30 percent on your wants, and 20 percent on savings. Below are more details on how to do this.

Spend 50 percent on needs. These bills are those that are necessary for survival, such as rent/mortgage, groceries, utilities, health care, insurance, and payment of the minimum amount on your debts. Other things like Starbucks, Netflix, and dining out might feel like needs, but if you get honest, they really aren’t (they fall into the next category). To get started, here’s a free worksheet. If you’re spending more than 50 percent on your needs, then look for areas to cut expenses or downsize your lifestyle. For instance, you could eat in (and make delicious coffee at home), maybe take public transportation to work, or even choose a smaller home or more modest car. While these compromises might not be very fun, they’re necessary to make you fiscally healthier. Plus, they’ll pay off in the long run, which will feel really good.

Allocate 30 percent for wants. The best way to look at this category is to think of everything as optional. It includes obvious choices like going to your favorite restaurant, joining a gym, or buying that new techie gadget or a gorgeous new purse. Another way to frame wants is, for instance, choosing a more expensive entrée like lobster instead of a pasta dish, or buying a Mercedes instead of a no-nonsense Honda. That said, living a spartan life with no feel-good experiences isn’t realistic. We all have desires. But if you find you’re spending more than 30 percent on these things, a way to cut back is to plan ahead on splurging and do it less often. This way, treating yourself might feel better than it normally would.

Sock 20 percent away on savings. This category, of course, includes your savings account, as well as investment accounts like IRAs, mutual funds, and stocks, which may or may not be part of your retirement. Besides saving money to pay for future bills, it’s also recommended to put away at least three months of expenses in an emergency fund to draw upon should you lose your job or experience another such unexpected life event. If you spend this allotment, start replenishing it as soon as you can. Other things that fall into savings are paying more on your debt than just the minimum payments because you’ll be reducing the principal and future interest you’ll owe; so in effect, you’re saving. While tucking funds away might seem impossible, once you get in the habit of it, you won’t miss it. And a few months down the road, when you take a look at the sum you’ve accumulated, you’ll most likely be super happy.

Admittedly, saving money and managing it is a challenge — know that you’re not alone. As of January 2022, the personal saving rate was 6.4%, down from 8.2% in December 2021. So take heart. If you’re saving anything at all, you should count that as a victory. You’ll be way ahead of the crowd. In the end, seeking a financial equilibrium and erring on the side of saving will contribute to a more abundant life in the long run.

Sources

https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

The Rise in Ransomware Attacks and How to Keep Safe

Cybersecurity experts estimate that there is a ransomware attack every 11 seconds. This is a big challenge for individuals, businesses, and governments alike.

In ransomware attacks, cybercriminals encrypt a victim’s network or data, making it inaccessible until a ransom is paid. Despite organizations’ efforts to reduce the attacks, cybercriminals are advancing their attack methods. For instance, an organization may have backups they can use to restore their systems, but the criminals also demand ransom not to publish the sensitive company information they have in their possession.

Ransomware is not a new cybersecurity threat. It is traced back to 1989 when the first ransomware was released through floppy disks and required a victim to send money to a post office box in Panama. As technology now has advanced to allow for always-on connectivity, the prevalence of ransomware has grown tremendously. The use of bitcoin and other cryptocurrencies as payment makes it more complicated as they are difficult to trace. These attacks—such as the WannaCry, CryptoLocker, etc.—have resulted in billions of dollars in losses through infrastructure and business outages and millions of dollars being paid to attackers.

Ransomware has grown so much that organized gangs are offering cybercriminals services for hire. This is made more intricate by the availability of ransomware-as-a-service (RaaS) to provide infrastructure to other cybercriminals to escalate their attacks.

Ransomware has become such a global threat that a joint advisory made up of CISA, FBI, NSA, and International Partners has called for every government, business, and individual to be aware of this threat and take necessary action to avoid becoming victims.

President Biden continuously issues warnings to business leaders to strengthen their companies’ cyber defenses. The risks of cybersecurity are expected to increase with the ongoing invasion of Ukraine by Russia.

On the other hand, there are efforts to reduce the threat scale by various groups. One such group is the Cyber Threat Intelligence League (CTI-League), made up of cybersecurity experts from different countries. They have helped take down malicious websites, detect vulnerabilities, collect and analyze different phishing messages, and assist law enforcement organizations in creating safer cyberspace.

Protecting Against Ransomware

Before a ransomware attack is fulfilled, there are detectable activities that can aid in mitigating an attack. In any case, the attackers target specific user behavior, unchanged default security configurations, and common technology vulnerability. This means that ransomware attacks can be avoided. Some ways to keep safe from ransomware include:

- Timely patches – Be sure to patch operating systems and other software immediately whenever a patch is released. Patching also should apply to cloud environments, including virtual machines, serverless applications, and third-party libraries.

- Keep backups – It is impossible to fully protect an organization’s network as one user action may expose the network to attacks. Regularly backing up data is crucial. Additionally, ensure that cloud backups are encrypted and can’t be deleted or altered. Lastly, always keep a backup version that is not accessible through the cloud to ensure business continuity in case of an attack.

- User training – Users are considered the weakest link in the line of defense against cybersecurity. An attack can start with a seemingly legitimate email containing a link or an attachment that downloads malware to a device once clicked. Therefore, continuous user training and phishing exercises will help reinforce user responses to suspicious emails.

- Secure and monitor RDP – As more people adopt remote working, they rely on the remote desktop protocol to connect to office computers or colleagues. This has made RDP one of the most commonly used methods for attackers to gain access to a network. Therefore, businesses should use Network Level Authentication (NLA) and use unique and complex passwords for users to authenticate themselves before making a remote connection. Other ways include multifactor authentication, setting time limits to disconnect inactive RDP sessions automatically, and limiting login attempts.

- Use up-to-date antivirus software – Employing the latest software is key. It should be used to regularly scan the systems and scan files downloaded from the internet before they are opened.

- Network monitoring – Use network monitoring tools and intrusion detection systems to look out for any suspicious activity.

The CISA, FBI, NSA, and International Partners joint advisory discourages paying ransom to cybercriminals and recommends following the CISA ransom response checklist and reporting to cybersecurity authorities such as the FBI, CISA or the U.S. Secret Service. System administrators should also follow incident response best practices that can aid in handling malicious activity.

Considerations When Selling a Business

According to the U.S. Small Business Administration and Project Equality, 60 percent of business owners plan to cash out of the business in the next 10 years. For the baby boomer generation, it’s especially important as they contemplate retirement, with this generation reportedly owning 2.3 million businesses. When it comes to getting a business ready for sale, there are many components to review and get organized before looking for prospective buyers.

The first thing owners looking to sell their business are often asked is why they’re selling. A sale may occur for many reasons – voluntary or not. Some people are looking to retire, while others might be looking to exit their business because things soured with partners. These are just some of the reasons why business owners or partners want to sell their business or stake in a company. Entrepreneur magazine says there are “three ways to leave a business – sell it, merge it or close it.”

According to Entrepreneur magazine, there are many considerations for business owners when they are contemplating selling. For profitable companies, it’s more often due to choosing to sell, but not always. When there’s the desire to sell a business, if the owners can show potential purchasers some or all of the following, chances are it will sell sooner than later and for a fair price: growing income, profitability, and a customer base, along with a business plan and product/services with long-term potential.

Another consideration is the timing of the sale. Ideally, getting the business’ house in order will benefit both the seller and the buyer. With this in mind, it’s important to have a few backup buyers in case the first deal falls through. One reason a deal may fall through is that the buyer didn’t qualify for financing before the sales process got serious. This planning can give the business owner and potential buyers time to review, audit, and organize financial records; review and determine the business structure; and determine and analyze the business’ customer base. This review and organization will help the new buyer maintain business continuity if they decide to purchase the business.

The next step is to get the proper documents in order. Organize the cash flow statement, balance sheet, and income statements, along with tax returns from the past few years. It’s important to inventory all equipment, intellectual property, trade secrets, etc. to see what can be sold and transferred and to verify the current market value of each. Taking stock of both sales records and suppliers—and getting contact information for both—will help make a sale more likely. Depending on if the information is proprietary or not, it’s important to have this ready to share, under confidentiality, with potential buyers. An operating manual and a general overview of the business are also necessary in order to show the company’s presence clean and repaired.

Another consideration is how business assets that aren’t so easy to touch will be valued. According to the American Bar Association, goodwill is an intangible asset, such as reputation, along with intellectual property like a trademark. The New York State Society of CPAs’ (NYSSCPA) publication, The CPA Journal, reports that goodwill has an indefinite life, and one way to see if it meets the test of being goodwill is if it “is inseparable from the business.”

Another consideration when selling a business is to see its recent cash flow and to calculate it properly for potential buyers. According to the NYSSCPA and the Statement of Financial Accounting Standards (SAFS) 95, cash flow from operating activities (CFO), per the SFAS 95’s statement of cash flow (SCF), is calculated by starting with the net loss or income and then factoring in differences in working capital and non-cash sales.

Your business’s CFO shows how much it earns from its operating activities, as the name implies. It’s important to see how this figure differs from investing or financing operations that may be ancillary to the company’s irregular financials. Once this information is known, it gives potential buyers an accurate assessment of the company they are considering buying to see if they’re comfortable with the existing business. Showing a business that’s doing well can help attract buyers at a fair price.

While each business is different and the reasons for exiting it vary, understanding what potential buyers are looking for can increase the chances of a fast sale at a fair price for both seller and buyer.

Sources

https://www.score.org/blog/how-profitably-exit-your-online-business

http://archives.cpajournal.com/2002/0102/features/f013602.htm

https://www.entrepreneur.com/encyclopedia/selling-your-business

https://www.americanbar.org/content/dam/aba-cms-dotorg/products/inv/book/213938/5070556_SamCh.pdf

https://www.cpajournal.com/2019/11/27/the-challenge-of-accounting-for-goodwill/

http://archives.cpajournal.com/old/14152806.htm

https://www.sba.gov/blog/7-tax-strategies-consider-when-selling-business

How to Manage Your Aging Parents’ Finances

Taking over your aging parents’ finances is not easy. But it’s something that can be handled in an organized, compassionate way. Here’s a roadmap that shows how to embrace it and do the right things for everyone involved.

Start the conversation early. Right now, your parents might not need any help. They might be handling everything just fine. But there will come a day when they can’t – and they’ll need your help. The National Institute on Aging recommends that parents give advance written consent to designated family members so they can discuss personal matters with doctors, financial representatives, and Medicare officials. If you don’t have this, you’ll be faced with some roadblocks. If you open the dialogue now, you’ll circumvent obstacles, as well as get a better feel for what their future needs might be.

Watch for the signs. If you don’t see your parents often, and even if you do, the signs of when you need to step in might be a bit hard to detect. That said, there are some things to look for that will indicate that their needs are changing.

- Unusual purchases. If you find out that your folks are buying things that don’t match their lifestyle or entering lots of contests and sweepstakes, then it’s time to speak up. Behavior like this might get out of hand – or worse, they might be getting scammed. Older people are most vulnerable to the vultures out there.

- Stacks of unopened mail. Watch for this, as the letters might be unpaid bills and/or solicitations for sweepstakes. Both are problematic.

- Complaining about money. If your folks seem to be always low on cash, or say “no” to activities that they usually enjoy, talk to them. They might need your help for a number of reasons, whether it’s reconciling accounts or remembering how to pay bills – or if they even paid them.

- Physical setbacks. Fading vision can impede driving to the bank and arthritis can be painful while writing checks or typing on the keyboard. Whatever ailment your parents might suffer from, this could be a cue that they need your assistance.

- Memory problems. This is somewhat self-explanatory, but specific things to look for are not knowing what day or year it is or just forgetting things that your parents once always remembered.

Start slowly. Instead of charging in and announcing that you’re taking control, take baby steps. Maybe offer to write checks for them. Or offer to pay a bill or two. Gradual, gentle steps make them feel more at ease and comfortable with the new way of doing things.

Gather important documents. Things to collect are account numbers, credit card info, birth certificates, insurance policies, deeds, and wills. Make sure they’re all current and up-to-date. Put them in a secure location so you’ll have easy access when you need them.

Consider power of attorney. This is key. Even if your parents don’t need your help at the moment, there will come a time when they will. There are several types of POA to consider: financial, medical, or general decisions. Unlike written consent, this gives you legal authority to act on their behalf when they’re unable to.

Communicate what’s going on. Once you’ve started to manage your parents’ finances, keep your siblings, as well as theirs, in the loop. This way, if you’re unable to handle something, you can ask for backup support.

Keep your finances separate. It might be the easiest thing to do – mix your parents’ finances with yours – but in the long run, it’s not such a good idea. It can become a slippery slope. Granted, there may be times when your parents need a loan, but for the sake of clarity and personal record-keeping, it’s best not to jeopardize your own retirement and savings goals.

If you need more help, reach out to the National Alliance for Caregiving. As we all know, the circle of life is inevitable. But caring for your parents might be one of the most important things you’ll ever do – and chances are, you’ll want to get it right.

Sources

https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/aging-parents-finances