Categories for

What A Difference Six Months Can Make

An alternate valuation date can reduce estate tax liability

If you have money invested in the stock market, you’re well aware of potential volatility. Needless to say, this volatility can affect your net worth, thus affecting your lifestyle. Something you might not think about is the potential effect on your estate tax liability. Specifically, if the value of stocks or other assets drops precipitously soon after your death, estate tax could be owed on value that has disappeared. One strategy to ease estate tax liability in this situation is for the estate’s executor to elect to use an alternate valuation date.

Alternative valuation date eligibility

Typically, assets owned by the deceased are included in his or her taxable estate, based on their value on the date of death. For instance, if an individual owned stocks valued at $1 million on the day when he or she died, the stocks would be included in the estate at a value of $1 million.

Despite today’s favorable rules that allow a federal gift and estate tax exemption of $12.06 million, a small percentage of families still must contend with the federal estate tax. However, the tax law provides some relief to estates that are negatively affected by fluctuating market conditions. Instead of using the value of assets on the date of death for estate tax purposes, the executor may elect an “alternate valuation” date of six months after the date of death. This election could effectively lower a federal estate tax bill.

The election is permissible only if the total value of the gross estate is lower on the alternate valuation date than it was on the date of death. Of course, the election generally wouldn’t be made otherwise. If assets are sold after death, the date of the disposition controls. The value doesn’t automatically revert to the date of death.

Furthermore, the ensuing estate tax must be lower by using the alternate valuation date than it would have been using the date-of-death valuation. This would also seem to be obvious, but that’s not necessarily true for estates passing under the unlimited marital deduction or for other times when the estate tax equals zero on the date of death.

Note that the election to use the alternate valuation date generally must be made with the estate tax return. There is, however, a provision that allows for a late-filed election.

All assets fall under alternate valuation date

The alternate valuation date election can save estate tax, but there’s one potential drawback: The election must be made for the entire estate. In other words, the executor can’t cherry-pick stocks to be valued six months after the date of death and retain the original valuation date for other stocks or assets. It’s all or nothing.

This could be a key consideration if an estate has, for example, sizable real estate holdings in addition to securities. If the real estate has been appreciating in value, making the election may not be the best approach. The executor must conduct a thorough inventory and accounting of the value of all assets.

Estate plan flexibility

If your estate includes assets that can fluctuate in value, such as stocks, be sure your executor knows about the option of choosing an alternate valuation date. This option allows flexibility to reduce the chances of estate tax liability. Contact your estate planning advisor for additional information.

© 2022

Beware The Five-Year Rule For Roth IRA Withdrawals

What makes Roth IRAs so appealing? Primarily, it’s the ability to withdraw money from them tax-free. But to enjoy this benefit, there are a few rules you must follow, including the widely misunderstood five-year rule.

3 types of withdrawals

To understand the five-year rule, you first need to understand the three types of funds that may be withdrawn from a Roth IRA:

Contributed principal. This is your after-tax contributions to the account.

Converted principal. This consists of funds that had been in a traditional IRA but that you converted to a Roth IRA (paying tax on the conversion).

Earnings. This includes the (untaxed) returns generated from the contributed or converted principal.

Generally, you can withdraw contributed principal at any time without taxes or early withdrawal penalties, regardless of your age or how long the funds have been held in the Roth IRA. But to avoid taxes and penalties on withdrawals of earnings, you must meet two requirements:

- The withdrawal must not be made before you turn 59½, die, become disabled or qualify for an exception to early withdrawal penalties (such as withdrawals for qualified first-time homebuyer expenses), and

- You must satisfy the five-year rule.

Withdrawals of converted principal aren’t taxable because you were taxed at the time of the conversion. But they’re subject to early withdrawal penalties if you fail to satisfy the five-year rule.

Five-year rule

As the name suggests, the five-year rule requires you to satisfy a five-year holding period before you can withdraw Roth IRA earnings tax-free or converted principal penalty-free. But the rule works differently depending on the type of funds you’re withdrawing.

If you’re withdrawing earnings, the five-year period begins on January 1 of the tax year for which you made your first contribution to any Roth IRA. For example, if you opened your first Roth IRA on April 1, 2018, and treated your initial contribution as one for the 2017 tax year, then the five-year period started on January 1, 2017. That means you were able to withdraw earnings from any Roth IRA tax- and penalty-free beginning on January 1, 2022 (assuming you were at least 59½ or otherwise exempt from early withdrawal penalties).

Note: If you’re not subject to early withdrawal penalties (because, for example, you’re 59½ or older), failure to satisfy the five-year rule won’t trigger a penalty, but earnings will be taxable.

If you’re withdrawing converted principal, the five-year holding period begins on January 1 of the tax year in which you do the conversion. For instance, if you converted a traditional IRA into a Roth IRA at any time during 2017, the five-year period began January 1, 2017, and ended December 31, 2021.

Unlike earnings, however, each Roth IRA conversion is subject to a separate five-year holding period. If you do several conversions over the years, you’ll need to track each five-year period carefully to avoid triggering unexpected penalties.

Keep in mind that the five-year rule only comes into play if you’re otherwise subject to early withdrawal penalties. If you’ve reached age 59½, or a penalty exception applies, then you can withdraw converted principal penalty-free even if the five-year period hasn’t expired.

You may be wondering why the five-year rule applies to withdrawals of funds that have already been taxed. The reason is that the tax benefits of Roth and traditional IRAs are intended to promote long-term saving for retirement. Without the five-year rule, a traditional IRA owner could circumvent the penalty for early withdrawals simply by converting it to a Roth IRA, paying the tax, and immediately withdrawing it penalty-free.

Note, however, that while the five-year rule prevents this, it’s still possible to use a conversion to withdraw funds penalty-free before age 59½. For example, you could convert a traditional IRA to a Roth IRA at age 45, pay the tax, wait five years and then withdraw the converted principal penalty-free.

What about inherited Roth IRAs?

Generally, one who inherits a Roth IRA may withdraw the funds immediately without fear of taxes or penalties, with one exception: The five-year rule may still apply to withdrawals of earnings if the original owner of the Roth IRA hadn’t satisfied the five-year rule at the time of his or her death.

For instance, suppose you inherited a Roth IRA from your grandfather on July 1, 2021. If he made his first Roth IRA contribution on December 1, 2018, you’ll have to wait until January 1, 2023, before you can withdraw earnings tax-free.

Handle with care

Many people are accustomed to withdrawing retirement savings freely once they reach age 59½. But care must be taken when withdrawing funds from a Roth IRA to avoid running afoul of the five-year rule and inadvertently triggering unexpected taxes or penalties. The rule is complex — so when in doubt consult a tax professional before making a withdrawal.

Sidebar: Ordering rules may help avoid costly mistakes

The consequences of violating the five-year rule can be costly, but fortunately there are ordering rules that help you avoid inadvertent mistakes. Under these rules, withdrawals from a Roth IRA are presumed to come from after-tax contributions first, converted principal second and earnings third.

So, if contributions are large enough to cover the amount you wish to withdraw, you will avoid taxes and penalties even if the five-year rule hasn’t been satisfied for converted principal or earnings. Of course, if you withdraw the entire account balance, the ordering rules won’t help you.

© 2022

Reflections on HABU: Sean Smith

At the beginning of August, Sean Smith, accounting and auditing manager, braved the Texas heat to attend Engineered Tax Advisory’s Highest and Best Use (HABU) Conference. The conference gathered accounting professionals from around the country to learn about identifying and implementing advisory services to better serve clients.

Sean answered a few questions about what he learned at HABU:

What is something learned that you know that you’ll use to help your clients?

The big one was a refresher on tax credit programs such as R&D, cost segregation, ERTC, and WOTC. I also got an overview of potential tax benefits associated with aviation, rooftop cellular equipment, solar equipment, and more that I think will benefit some of my clients. Another real highlight of the conference was being introduced to specialists to whom I can refer clients as needed.

What was the most memorable session you attended?

The presentation on tax benefits associated with private jet ownership, as well as financing, operations, and legal issues.

What was your favorite part of the conference?

Making new connections and strengthening existing ones.

To find out how Sean can use what he learned at HABU to help your business, contact RBF today.

Department of Education Announces Overhaul of Federal Student Loan System

On October 31, the Department of Education announced large-scale changes to the federal student loan system. These changes come as the Biden administration’s broader student loan forgiveness plan is held up by legal challenges.

Education Secretary Miguel Cardona called the new rules, “a monumental step forward in the Biden-Harris team’s efforts to fix a broken student loan system.” The following changes are scheduled to go into effect on July 1, 2023.

- Interest capitalization—where unpaid interest is added to the borrower’s principal, resulting in borrowers owing more than the original loan amount—will be significantly curbed.

- Rules and restrictions that have historically impeded the Public Service Loan Forgiveness program, which allows borrowers who work for the government or specific nonprofits to have their debt canceled after a decade, will be overhauled.

- ‘Borrower Defense’ rules will be simplified. This program allows students who were misled or defrauded by their schools to discharge some or all of their student loan debt.

- Paperwork will be simplified and a broader range of circumstances will be available to borrowers who are eligible for relief because they have become totally and permanently disabled.

For more details on these new rules and changes, read the full news release from the Department of Education here: https://www.ed.gov/news/press-releases/education-department-releases-final-regulations-expand-and-improve-targeted-debt-relief-programs

Do You Have an Investment Exit Strategy?

Are you a trader or an investor? The difference is frequently discerned by how closely you monitor the stock market and how quickly you move in and out of investments. Traders are often referred to as “market timers” because they actively seek to buy into positions when share prices drop and sell out when those prices rise.

Many financial planners and professional money managers are not strong proponents of market timing. The reality is that no one can predict market movements accurately over the long term, so success is often a matter of luck and opportunity.

However, market timing is not the same as having a carefully structured and disciplined investment exit strategy. One reason this is important is that it can help prevent investors from panic selling. If you have considered the growth potential and market risks of a particular security or type of investment and you put parameters in place that reflects your comfort level, then you can control your losses to a great extent. Without this analysis, you may be subject to emotional responses and sell for a significant loss because you can’t take the stress of watching your investment lose money day after day.

Exit Strategy

When share prices drop unexpectedly – and continue to fall – many investors let their emotions get the best of them and sell prematurely. Having a preconceived exit strategy is a good way to prevent this type of panic selling.

An exit strategy means that you set a target sell price, but it’s important that you have the discipline to sell at that price. Often when a stock’s share price is rising quickly, it is tempting to “let it ride” and ignore your exit strategy. However, that tide could change quickly in the other direction, turning a profitable trade into a loss. When this happens, you may stubbornly hang on to that declining stock knowing that you missed your opportunity to cash in – and hope that it will come around again.

An effective exit strategy should have two plans in place: a price point to sell for a gain and a price point to sell for a loss. This tactic can help keep your asset allocation strategy on target by not letting gains or losses in any one position throw your target asset allocation percentages out of whack. At the same time, you can manage risk by not allowing your portfolio to lose too much money. Certain tactics can help implement your exit strategy. For example:

- Stop-Loss – an order to sell a security when its price is declining at the point when it reaches your assigned stop price (sell-stop).

- Stop-Limit – a limit order gives instructions to sell a stock at a minimum price point. Stop-limit orders can be set to expire at the end of the current market session or carried over to future trading sessions (GTC – good ‘til canceled).

- Trailing Stop – a modified stop order that can be set as either a percentage or dollar amount below or above the market price of a security.

Tax Considerations

An investor’s exit strategy should take into consideration potential taxes on capital gains. The amount you pay depends on how long you hold a position. If held for less than one year, the short-term capital gains tax rate is the same as your regular income tax. If held for one year or longer, the tax rate is 0 percent, 15 percent, or 20 percent – depending on income tax bracket and filing status. When determining your exit strategy, it is prudent to set a long-term perspective with a plan to harvest gains on positions more than a year old.

Risk Management

Setting up an exit strategy is one component of a risk management plan. The following are other complementary strategies you can deploy to set boundaries on how much money you are willing to lose.

- Risk/reward ratio – Set a minimum ratio. For example, 1:3 means you are willing to risk $100 for a potential profit of $300.

- 1 percent (or 2 percent) rule – Limit your risk to investing no more than 1 percent of your portfolio on any one trade.

- Diversification – Spreading your investments across a variety of assets in order to reduce portfolio losses.

Remember that investing is replete with uncertainty; not even the most experienced money managers can predict the direction of the markets. Developing an exit strategy for stock holdings is a way to minimize potential losses while strategically targeting specific returns to meet your goals.

Are You Missing Out on the Increased Child Tax Credit?

The American Rescue Plan Act of 2021, also referred to as the COVID-19 Stimulus Package or ARPA, was a $1.9 trillion bill passed by Congress to stimulate the U.S. economy as the country emerges from the pandemic.

Included in that legislation was a one-year groundbreaking enhancement of the child tax credit for 2021 only. Though it made no changes to the rules about dependency, the law boosted the existing credit from $2,000 to $3,000 for parents of a child aged 6 to 17 (this is a one-year increase from the normal age 16 cutoff).

The credit is intended for lower income families and includes a phaseout that reduces the credit by $50 for each $1,000 (or fraction thereof) by which the taxpayer’s modified gross income exceeds the thresholds illustrated in this table.

| 2021 MAGI PHASEOUT – CHILD TAX CREDIT | |

| Filing Status | Threshold |

| Married Filing Joint | 150,000 |

| Heads of Household | 112,500 |

| Others | 75,000 |

Not only did the bill increase the credit, it also required the IRS to provide monthly payments to parents of up to half of the amount of the credit from July through December of 2021, with the balance credited to them when they filed their 2021 tax return.

This is where implementing the credit got complicated for the IRS. They needed to determine, based on prior tax filings, who was entitled to pre-payments. As you might imagine this is where things could go awry, and they did. Many individuals not entitled to the advance payments received them and many who should have received them did not.

A recent report from the Treasury Inspector General for Tax Administration (TIGTA) shows the IRS, between July and November of 2021, made payments to approximately 1.5 million taxpayers who were not entitled to the payments totaling more than $1.1 billion. The report also found that there were 4.1 million eligible taxpayers who did not receive payments totaling nearly $3.7 billion.

If you were entitled to but did not receive advance payments, it may be because your income in prior years was below the filing requirement and the IRS did not have the data needed to determine if you qualified for an advance payment. It may also be the case if you were required to file and simply didn’t do so. You may also be missing out on the credit, which is refundable even if you have no tax liability, if you have not filed for 2021 because your 2021 income is below the filing requirement. Or, you may have had a new child in 2021 and have not filed yet.

This credit is still available. So, whatever the reason, if you think you might qualify and didn’t receive the full amount of the credit by pre-payments or on your 2021 return if you’ve already filed it, give our office a call so your circumstance can be reviewed to make sure you are not leaving a substantial tax refund on the table.

When to Hire a Fractional CFO

Every entrepreneur starts their company with their own vision of what the future holds. Maybe you thought you’d just work from a home office, managing every function and loving every minute of it. Maybe you always knew you were going to make it big and would need a suite of executives, a team of sales and marketing professionals, and a whole bunch of support staff to help the whole thing run like a clock. Whatever you anticipated, if you’ve gotten to the point where your books and your financial planning have gotten beyond your ability, it’s time to think about bringing on someone with more time and experience. While you may be tempted to hire a full-time CFO, there are many benefits to using the fractional CFO services offered by a bookkeeping or accounting firm.

Every growing business needs accurate and timely record-keeping and reporting. But if your needs have grown beyond basic bookkeeping and you need financial insights, accounting management, KPI tracking, and analysis, it’s time to hire a professional. In the past, businesses in your position have had little choice but to bring on a Chief Financial Officer. Today, an increasing number of successful entrepreneurs are recognizing that hiring a virtual CFO — also known as a fractional CFO — makes a great deal of sense. And you can easily access this service by contacting your professional.

A virtual CFO provides outsourced financial services at a fraction of the cost of a full-time employee’s salary. While every business is different and compensation can shift based on years of experience, geographic location, and the scope of the actual work, there’s no getting around the fact that the median salary paid to a Chief Financial Officer in the United States is $417,857. That’s a pretty big hit to take as a new expense, and that doesn’t count the outlay for benefits, bonuses, and associated costs starting with office space and equipment and going on from there.

While the services afforded by a full-time Chief Financial Officer would undoubtedly be valuable, most businesses have legitimate questions about whether the outlay of cash is worth the price. Now consider instead the option of using your CPA firm’s virtual CFO service. They have invested in bringing on professionals who possess all of the same knowledge and experience, but a fractional CFO service participates on a customized schedule to suit the needs of your company — and charges according to a much more reasonable contracted monthly fee, without the need to pay benefits, bonuses, or other expenses.

The difference between the two costs speaks for itself. But do you really get the same level of service? And how do you know that you’re ready or have a need for these services?

Most virtual CFOs were either previously employed as Chief Financial Officers but have chosen to step away from full-time work in favor of a more flexible schedule, or they were qualified to be Chief Financial Officers but opted for a different path. Whatever their specific background, your accounting firm has hired them because they have the exact qualifications needed to help small to mid-sized businesses valued between $1 million and $50 million that have needs beyond their management’s time or abilities and the interest in helping your business succeed.

To get a sense of whether your business needs a virtual CFO, consider these services that they offer and determine whether having them would help you achieve your goals:

- A virtual CFO will provide you with financial strategies and projections to improve your operational performance

- A virtual CFO will prepare in-depth monthly reports that incorporate all of the pertinent data about your organization and use them to identify what is either driving your growth or preventing it. Beyond simple preparation, they understand what information is important and has meaning and help you make good use of it.

- A virtual CFO will manage your assets and monitor your cash flow to improve your overall standing, minimize risk, and optimize your profitability and ability to grow.

- A virtual CFO will help you create a financial plan that you can follow. They will also track and measure whether you are sticking to the plan and whether it is helping or needs to be revised.

- A virtual CFO will give you the gift of time. Rather than you struggling with these tasks or getting them done while sacrificing time that could be better spent on other things, a virtual CFO will take this task off of your to-do list, and do the job with ease and expertise.

If you would like more information on the virtual CFO services offered by our accounting firm, or any of the other ways that we can help, please contact our office today.

Is This an Opportune Time to Convert Your Traditional IRA to a Roth IRA?

If your traditional IRA is invested in stocks and/or mutual funds, the recent substantial downward slide by the stock markets may provide a unique opportunity to convert your traditional IRA to a Roth IRA at a low cost, and then benefit when the markets recover.

Why would you want to do that? Because Roth IRA distributions provide tax free retirement benefits while payouts from Traditional IRAs are taxable.

Of course there is no assurance that the markets will not continue to decline, and this may not be the most opportune time to make a conversion in your specific circumstances but is something you may want to consider. Conversions provide the most benefit to younger individuals who can look forward to many years of the tax-free growth provided by a Roth IRA.

You don’t have to convert all of your traditional IRA in one year. You can convert what you can afford to pay the tax on each year.

Here Is How It Works – The tax code allows individuals to convert any portion of their traditional IRA to a Roth IRA by paying tax on the conversion as though taking a distribution from the traditional account. Thus, if you make a conversion you are taxed on the conversion based upon the tax rates that apply to your normal income plus the traditional IRA amount being converted.

Of course, if in 2022 you have abnormally lower income, that could make the conversion tax even less. The following table includes the marginal tax rates for 2022.

| Marginal Tax Rates for 2022 | ||||

| Marginal Rate | Filing Status | |||

| — | Single | HH | MFJ | MFS |

| 10.0% | 10,275 | 14,650 | 20,550 | 10,275 |

| 12.0% | 41,775 | 55,900 | 83,550 | 42,775 |

| 22.0% | 89,075 | 89,050 | 178,150 | 89,075 |

| 24.0% | 170,050 | 170,050 | 340,100 | 170,050 |

| 32.0% | 215,950 | 215,950 | 431,900 | 215,950 |

| 35.0% | 539,900 | 539,900 | 647,850 | 323,925 |

| 37.0% | – | – | – | |

Example When Using the Table – Let’s say you are filing single and your taxable income without an IRA conversion amount is $45,000, which has a marginal rate of 12%, and you are converting $40,000. This brings your taxable income to $85,000, which is still in the 12% bracket (it’s more than $41,775 but less than $89,075, the start of the next rate). This means the tax on the conversion would be $4,800 (12% of $40,000). If you did the conversion in a year when your other income was more and when combined with the conversion amount you are in the 22% bracket, the tax on the conversion would be $8,800, $4,000 more than when you are in the 12% bracket.

Other Issues:

- There is no income limitation on making a conversion, thus anyone can do a conversion.

- Higher income taxpayers can use the conversion to circumvent the AGI limits for contributing to a Roth IRA.

- Once a conversion is made it cannot be undone.

- Some individuals for various reasons have made non-deductible contributions to their traditional IRAs. For distribution or conversion purposes, all an individual’s IRAs (except Roth IRAs) are considered as one account and any distribution or converted amounts are deemed taken ratably from the deductible and non-deductible portions of the traditional IRA, and the portion that comes from the deductible contributions would be taxable.

Give our office a call if you would like to explore the possible benefits of a traditional to Roth IRA conversion.

Health Savings Accounts Fill Multiple Tax Needs

The Health Savings Account (HSA) is one of the most misunderstood and underused benefits in the Internal Revenue Code. Congress created HSAs as a way for individuals with high-deductible health plans (HDHPs) to save for medical expenses that are not covered by insurance due to the high-deductible provisions of their insurance coverage.

However, an HSA can act as more than just a vehicle to pay medical expenses; it can also serve as a retirement account. For some taxpayers who have maxed out their retirement-plan options an HSA provides them another resource for retirement savings – one that isn’t limited by income restrictions in the way that IRA contributions sometimes are.

Although the tax code refers to these plans as “health” savings accounts, they can also be used for retirement, as there is no requirement that the funds be used to pay medical expenses. Thus, a taxpayer can pay medical expenses with other funds, thus allowing the HSA to grow (through account earnings and further tax-deductible contributions) until retirement. In addition, should the need arise, the taxpayer can still take tax-free distributions from the HSA to pay medical expenses.

Withdrawals from an HSA that aren’t used for medical expenses are taxable and – depending on the taxpayer’s age – can be subject to penalty. Once a taxpayer has reached age 65, nonmedical distributions are taxable but not subject to a penalty (the same as for a traditional IRA once the IRA owner reaches age 59½). At the same time, regardless of age, a taxpayer can always take tax-free distributions to pay medical expenses.

Example: Henry is age 70 and has an HSA account from which he withdraws $10,000 during the year. He also has unreimbursed medical expenses of $4,000. Of his $10,000 withdrawal, $6,000 ($10,000 – $4,000) is added to Henry’s income for the year, and the other $4,000 is tax-free.

Eligible Individual – To be eligible for an HSA in a given month, an individual:

- must be covered under a HDHP on the firstday of the month;

- must NOT also be covered by any other health plan (although there are some exceptions);

- must NOT be entitled to Medicare benefits (i.e., generally must be younger than age 65); and

- must NOT be claimed as a dependent on someone else’s return.

Any eligible individual – whether employed, unemployed or self-employed – can contribute to an HSA. Unlike with an IRA, there is no requirement that the individual have compensation, and there are no phase-out rules for high-income taxpayers. If an HSA is established by an employer, then the employee and/or the employer can contribute. Family members or any other person can also make contributions to HSAs on behalf of eligible individuals. Both employer contributions and employee contributions made via the employer’s cafeteria plan are excluded from the employee’s wage income. Employees who make HSA contributions outside of their employers’ arrangements are eligible to take above-the-line deductions – that is, they don’t need to itemize deductions – for those contributions.

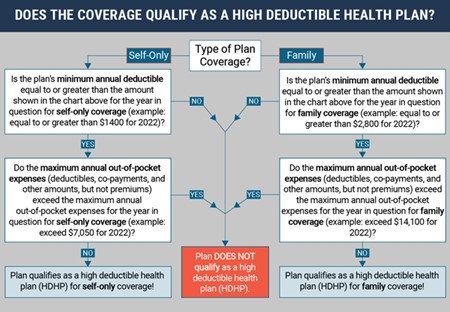

The Monetary Qualifications for a HDHP –

Example – Family Plan Does Not Qualify: Joe has purchased a medical-insurance plan for himself and his family. The plan pays the covered medical expenses of any member of Joe’s family if that family member has incurred covered medical expenses of over $1,000 during the year, even if the family as a whole has not incurred medical expenses of over $2,800 during that year. Thus, if Joe’s medical expenses are $1,500 during the year, the plan would pay $500. This plan does not qualify as a HDHP because it provides family coverage with an annual deductible of less than $2,800.

Example – Family Plan Qualifies: If the coverage for Joe and his family from the example above included a $5,000 family deductible and provided payments for covered medical expenses only if any member of Joe’s family incurred over $2,800 of expenses, the plan would then qualify as a HDHP.

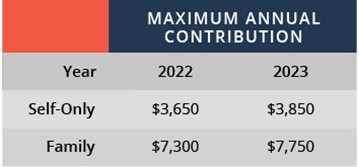

Maximum Contribution Amounts – The amounts that can be contributed are determined on a monthly basis and are calculated by dividing the annual amounts shown below by 12. Thus, if an individual’s health plan only qualified that person for an HSA for 6 months out of the year, then that person’s contribution amount would be half of the amount shown.

In addition to the amounts shown, an eligible individual who is age 55 and older can contribute an additional $1,000 per year.

How HSAs Are Established – An eligible individual can establish one or more HSAs via a qualified HSA trustee or custodian (an insurance company, bank, or similar financial institution) in much the same way that an individual would establish an IRA. No permission or authorization from the IRS is required. The individual also is not required to have earned income. If employed, any eligible individual can establish an HSA, either with or without the employer’s involvement. Joint HSAs between a husband and wife are not allowed, however; each spouse must have a separate HSA (and only if eligible).

If you have questions related to how an HSA could improve your long-term retirement planning or health coverage, please call our office.

Pump Up Tax Savings With The Fuel Credit

Companies that wish to reduce their tax bills or increase their refunds shouldn’t overlook the fuel tax credit. It’s available for federal tax paid on fuel used for nontaxable purposes.

When does the federal fuel tax apply?

The federal fuel tax, which is used to fund highway and road maintenance programs, is collected from buyers of gasoline, undyed diesel fuel and undyed kerosene. (Dyed fuels, which are limited to off-road use, are exempt from the tax.)

But purchasers of taxable fuel may use it for nontaxable purposes. For example, construction businesses often use gasoline, undyed diesel fuel or undyed kerosene to run off-road vehicles and construction equipment, such as front loaders, bulldozers, cranes, power saws, air compressors, generators and heaters.

As of this writing, a federal fuel tax holiday has been proposed. But even if it’s signed into law (check with your tax advisor for the latest information), businesses can benefit from the fuel tax credit for months the holiday isn’t in effect.

How much can you save?

Currently, the federal tax on gasoline is $0.184 per gallon and the federal tax on diesel fuel and kerosene is $0.244 per gallon. Calculating the fuel tax credit is simply a matter of multiplying the number of gallons used for nontaxable purposes during the year by the applicable rate.

So, for instance, a company that uses 7,500 gallons of gasoline and 15,000 gallons of undyed diesel fuel to operate off-road vehicles and equipment is entitled to a $5,040 credit (7,500 x $0.184) + (15,000 x $0.244).

This may not seem like a large number, but it can add up over the years. And remember, a tax credit reduces your tax liability dollar for dollar. That’s much more valuable than a deduction, which reduces only your taxable income.

Keep in mind, though, that fuel tax credits are includable in your company’s taxable income. That’s because the full amount of the fuel purchases was previously deducted as business expenses, and you can’t claim a deduction and a credit on the same expense.

How do you claim it?

You can claim the credit by filing Form 4136, “Credit for Federal Tax Paid on Fuels,” with your tax return. If you don’t want to wait until the end of the year to recoup fuel taxes, you can file Form 8849, “Claim for Refund of Excise Taxes,” to obtain periodic refunds.

Alternatively, if your business files Form 720, “Quarterly Federal Excise Tax Return,” you can claim fuel tax credits against your excise tax liability.

Why pay if you don’t have to?

No one likes to pay taxes they don’t owe, but if you forgo fuel tax credits that’s exactly what you’re doing. Given the minimal burden involved in claiming these credits — it’s just a matter of tracking your nontaxable fuel uses and filing a form — there’s really no reason not to do so.

©2022