Categories for

8 Ways to Save on School Supplies

It may feel like summer is still in full swing, but school will be starting soon. Yes, you heard that right. This means that you probably need to get prepared for the inevitable cash outlay ahead. But it doesn’t have to cost an arm and a leg. Here are some ways to navigate the upcoming expenditures and save a penny or two.

Start Early

We’re talking a few weeks ahead, if possible. If you wait until the last minute, supplies might run out. You may have to spend time online searching and/or driving from store to store – and paying the premium both in terms of products and gas. If you spread out purchases a little at a time, you won’t feel the financial hit so severely. Dive in early and you’ll thank yourself when it’s all over.

Conduct a Supply Audit

Dig into those drawers, closets, and storage bins for school supplies from last year. Chances are, you bought a set of, say, pencils and all are not used. When you’re done, put what you’ve found in a central location and make your shopping list. Be sure to keep this list handy (on your phone, or in your bag if you’ve handwritten it). Another way to keep track of what you already have is to snap a pic of it.

Swap With Friends

Do this before you spend any money. Organize a small gathering with other parents, trade your wares, figure out what you need, then get going.

Head to the Dollar Store

After you’ve audited and swapped, check out bargain basement stores. Here, you’ll find big savings on basics like notebooks, and pencils, plus hand sanitizer and facial tissues.

Scour Thrift Stores

While thrift stores might not have supplies in terms of schoolwork, they’ll have back-to-school clothes you can buy for a song – aka pretty darn cheap. You might look for backpacks here, too, which are a must-have. Tip: Don’t let your kiddos wear their new duds immediately. Save them for the first day (and days after) so they’ll feel like they’re starting the new year with a 100 percent fresh start.

Shop on a Sales Tax Holiday

Lots of states have these and during this time (or day or weekend), you can buy computers, clothing, and school supplies without paying sales tax. Here’s a state sales tax holiday list for you.

Follow Popular Stores on Social Media

Many companies send their followers coupon links and advance notice about juicy sales. Several to watch on Facebook and Twitter are Staples, Office Depot, Target, Best Buy, as well as Coupons.com, and RetailMeNot.

Make One Trek Solo

While taking the kiddos along can be fun and a great bonding experience, chances are they’ll plop things in your cart you might not want – and run up the bill. By yourself, you can get in and out quickly and control the cost.

Going back to school can be a challenging transition, both for kids and parents. However, if you plan ahead and stay on track, you can give yourself an A+ for all you’ve accomplished.

Sources

https://www.moneycrashers.com/back-to-school-supplies-list-tips/

How Businesses Can Mitigate Inflation & Maintain Pricing Power

Whether it’s tariffs, trade wars, or post-pandemic inflation caused by kink-ridden supply chains and what many experts believe to be excess money printing, inflation is an insidious drag on businesses’ operations. When it comes to energy’s contribution to inflation, the U.S. Energy Information Administration (EIA) reports that crude and natural gas prices in 2022 have increased on an annualized and weekly basis. Looking at the snapshot of 7/21/2022, WTI crude on the futures market was $96.35 a barrel. This was up more than $26 compared to 12 months ago, and $0.57 higher than a week earlier. For the same time frame, natural gas futures were $7.932/MMBtu, an increase of $3.973 from 12 months ago and an increase of $1.332 from a week earlier.

When it comes to businesses using any type of commodity, they’re faced with the question of how to raise retail prices when their prices increase. Many business owners are hesitant to increase prices on their goods and services as they fear it will drive away customers. But in light of increasing input prices, not implementing price increases correctly will impact a business’s earnings and profitability.

As McKinsey & Company explains, there are many considerations for why businesses have had trouble with mitigating costs in light of rising input costs. It’s important to monitor raw material costs with a fine-tooth comb. Businesses that bury costs of commodities, labor, or tariffs under general accounting categories hide spikes in input costs due to factoring in ancillary costs. If volatile input or uncontrollable factors, however, like tariffs can be monitored independently and in real time, businesses are more likely to be able to increase prices – and do so more gradually. With this in mind, McKinsey & Company highlights four practices that businesses can implement to combat pressure from input costs and pushback from customers who question the reason for price increases.

1. Create a Database of Dynamic Costs

By looking at historical records going back as far as 36 months, businesses can determine trends and keep track of increases or decreases in input materials to share with the sales and customer service departments, who can then communicate with customers. Along with looking at how contracts are written and if there are escalator clauses that permit conditions to adjust for increases in input materials, taking steps to accurately measure the impact of raw material costs can be helpful for price increase considerations.

A business could look at costs by department. If a plating department at a manufacturing company plates 50,000 pieces of metal a month, incurs $200,000 of direct material costs, and has $50,000 in labor and overhead costs, that can be broken down into a per unit cost of $4 for materials and $1 of labor and overhead costs. If the per unit cost of materials fluctuates, investigation can occur through the supply chain from the supplier to the price of futures contracts to see if prices can be negotiated or must be increased for customers.

2. Mind the Economy

Businesses are advised to keep an eye on current economic conditions. This is how companies can set a dynamic pricing strategy. Building on the first step, it’s advised to index prices to those of commodities to reduce the lag time between when companies experience changes in costs for their input materials and when retail prices reflect the true cost to the company. Be it fuel, wood, coffee, or metals, understanding how the price of commodities fluctuates in real-time is essential to determine when and how to adjust prices for retail customers. It can also help businesses determine how competitors are adjusting their pricing to customers, how far prices could increase, and how to augment the delivery of goods or services to stay competitive and profitable.

In addition to escalation clauses, companies adapting to changing input material prices could consider introducing shorter-term contracts, looking for more competitive suppliers, and/or substituting different but equal quality/performance materials.

3. Coaching Staff to Educate and Explain Price Fluctuations

Continual evaluations for sales teams are imperative. Supervisors must see what accounts have (and have not) been informed of price increases. They should focus on what accounts have accepted price increases (and what level of price increases have been accepted). They also should look at what accounts are likely to accept price increases and what accounts are not likely to accept price increases. Businesses also must factor in the business cycle for the sales process and how each account is performing relative to its price increase targets due to cyclical increases in input commodity prices and interest rates for financing availability. Ongoing coaching should be implemented to identify major issues and ways to resolve them. Anticipating and preparing sales representatives for customer questions through role-playing can help better prepare employees to explain why price increases are a part of doing business.

4. Managing Performance

Businesses must play the long game after products or services have been priced accordingly to commodity and input prices. Since inflation follows the economic cycle, upside and downside pricing dynamics can catch companies off guard. Consistently updated product or service pricing systems and prepared sales teams can lead to more profitable margins and hopefully the ability to weather volatile and long-term price spikes.

Much like the price of commodities and labor fluctuate based on dynamic market conditions, finding ways to adapt one’s business practices can increase the chances of surviving and thriving in a challenging economy.

Sources

4 Common Depreciation Methods and Their Uses

Depreciation is the accounting concept that evaluates an asset’s useful life. As the Internal Revenue Service (IRS) explains, depreciable property – which could include equipment, structures, means of transportation, fixtures, etc. – is examined to see how many years the purchase price can be averaged and “deducted from taxable income.” This is in contrast to “full expensing,” which allows companies to write off investments straight away. For dual-use property (personal and commercial), only the portion of property that’s used for business may be depreciated. Property eligible for depreciation must (1) be owned by the business, (2) be used for business purposes/income-producing activity, and (3) have a determinable useful life.

1. Straight Line Depreciation Method

This method of depreciation determines a constant amount to expense annually over the useful life of the property. It’s calculated as follows, with the following example circumstances assumed:

Machinery costing $50,000 with a life of 12 years and $2,500 in salvage value.

Annual Depreciation = (Cost – Salvage Value) / Useful life

= ($50,000 – $2,500) / 12

= $47,500 / 12

= $3,958.33

Considerations

When implementing this method of depreciation, if the asset’s useful life and salvage value is assumed incorrectly, it could skew results. For assets that become outdated prematurely and/or require higher maintenance costs toward the end of their useful life, this method can lead to improper results.

2. Double Declining Balance Depreciation Method

This method, generally speaking, is double that of the straight-line rate.

Annual Depreciation Rate = (100% / Useful life of asset) x 2

Annual Depreciation Rate = (100% / 10) x 2 = 20%

Let’s assume that property, plant, and equipment (PP&E) cost $75,000, will produce for 10 years, and have a salvage value of $6,000.

From there, we work to establish the Periodic Depreciation Expense (PDE)

PDE = Beginning Book Value x Rate of Depreciation

Using the formula for PDE, we get: $75,000 x 0.20 (20 percent) = $ 15,000 for the first year’s depreciation expense.

Then, the first year’s depreciation expense is subtracted from the item’s beginning book value. Ending Book Value = $75,000 – $15,000 = $60,000

To determine each subsequent year’s ending book value, the calculation begins with last year’s ending book value minus the newly calculated annual depreciation expense.

Year 2 Calculation for Ending Book Value: $60,000 – ($60,000 x 0.20 = $12,000) = $48,000

Considerations

This method expenses a greater proportion in the earlier years compared to the later years. This is useful for assets that produce more for a business in their earlier years compared to later years. This method can help businesses depreciate items that lose value quickly, such as electronics, and similar items that become obsolete due to improving technology. It’s not necessarily double or 200 percent of the straight-line rate. It could be more or less than double the straight-line rate. However, the double depreciation rate does remain constant over the depreciation process.

3. Units of Production Depreciation Method

This method takes either the amount of discrete time utilized for production or the tally of items to be manufactured with the production equipment subject to depreciation. It’s calculated as follows:

Depreciation Expense = [(Cost – Salvage value) / (Life in Number of Units)] x Number of Units Produced During Accounting Time Frame.

Let’s assume a piece of equipment costs $100,000, has a projected lifetime production ability of 150 million widgets, and will salvage for $10,000. It’s projected to create an output of 25 million widgets within the accounting year.

Depreciation Expense = [($100,000 – $10,000) / 150 million] x 25 million

= ($90,000 / 150 million) x 25 million

= 0.0006 (unit) x 25 million

= $15,000

Considerations

This method can help businesses, such as manufacturers, that produce discrete items that can be counted and expensed per piece. Depreciation starts when the manufacturer begins to make items and stops when the unit has produced all of its life’s items within a pre-defined time frame.

4. Sum-of-the-Years Digits Depreciation Method

This type of depreciation is calculated as follows:

Remaining Life (RL) of an asset is divided by the sum of the years’ digits (SYD) x Depreciation Base. The Depreciation Base = Cost – Salvage Value

Assuming there are equipment costs of $50,000, with a useful life of 12 years and a salvage value of $3,500. Depreciation Base = $50,000 – $3,500 = $46,500

RL = the remaining life of the asset. When the item starts running, it will have 12 years of remaining life. One year later, or 12 months after usage began, the asset will have 11 years remaining, and so on. For an item with 12 years of useful life, it will be “the sum of the years” or 1+2+3+4+5+6+7+8+9+10+11+12.

The first year of use or the item’s Remaining Life will be 12 / 78 = 0.1538. Then 0.1538 x $46,500 = $7,153.85.

Year 2 would be calculated as 11 / 78 = 0.1410. Then 0.1410 X $46,500 = $6,557.69.

Considerations

This method is another way to speed up the percentage of depreciation sooner, instead of toward the end of the asset’s useful life. The longer the asset is used, the less utility the asset provides to the business. Therefore, it helps businesses take advantage of depreciation sooner. It’s a trade-off for items that require more maintenance as time goes on, as the item’s value drops inversely.

Conclusion

Depending on the type of business and what it produces or provides as a service, understanding how depreciation works can give an accurate picture of a company’s finances and help with navigating tax laws efficiently.

Ways to Maximize Business Deductions

As a small business owner, you should always be on the lookout for legitimate ways to minimize your taxes. Waiting for year-end to do your tax planning can be too late and you may miss many possible opportunities. The following are valuable tips that help you maximize your business deductions.

New Business – Normally the costs of starting a business must be amortized (deducted) over 15 years. But taxpayers can elect to deduct up to $5,000 of start-up expenses and $5,000 of organizational expenses on the return for the first year of the business. A qualifying start-up cost is one that would be deductible if it were paid or incurred to operate an existing active business in the same field as the new business, and the cost is paid or incurred before the day the active trade or business begins. Examples of qualified start-up costs include:

- Surveys/analyses of potential markets, labor supply, products, transportation facilities, etc.;

- Wages paid to employees, and their instructors, while they are being trained;

- Advertisements related to opening the business;

- Fees and salaries paid to consultants or others for professional services; and

- Travel and related costs to secure prospective customers, distributors and suppliers.

Each of the $5,000 amounts is reduced by the amount by which the total start-up expenses or organizational expenses exceeds $50,000. Expenses not deductible in the first year of the business must be amortized over 15 years.

Legal and Professional Fees – incurred in setting up the business would fall under the organizational expense first year deduction of $5,000 and the balance would be amortized over 15 years. However, legal, and professional fees incurred after the business is up and running can be expensed.

Spousal Joint Ventures – When both spouses in a married couple are involved in the operation of an unincorporated business, it is common – but incorrect – for all that business’s income to be reported as one spouse’s income as a sole proprietorship on IRS Schedule C. In which case, the spouse not filing a Schedule C loses out on the chance to accumulate his or her own eligibility for Social Security benefits and the ability to fund a retirement account.

In addition, to claim a childcare credit, both spouses on a joint return must have earned income (or imputed income if one of the spouses is a full-time student or is disabled), so unless the non-Schedule C spouse has another source of earned income, the couple will not be allowed a childcare credit.

There are two ways to remedy this situation, either: (1) by establishing a partnership or (2) a joint venture (each spouse files a Schedule C with their share of the income, deductions, and credits).

Self-employed Health Insurance – If you are a self-employed individual, you can deduct 100% (no AGI reduction) of the health insurance premiums without itemizing your deductions. This above-the-line deduction is limited to net profits from self-employment.

Home Office – Small business owners may qualify for a home-office deduction, which will help them save money on their taxes and benefit their bottom line. Taxpayers can generally take this deduction if they use a portion of their home exclusively for their business and on a regular basis. Plus, this deduction is available to both homeowners and renters.

There are actually two methods to determine the amount of a home-office deduction: the actual-expense method and the simplified method.

Actual-Expense Method – The actual-expense method prorates home expenses based on the portion of the home that qualifies as a home office, which is generally based on square footage. Aside from prorated expenses, 100% of directly related costs, such as painting and repair expenses specific to the office, can be deducted. Unlike the simplified method, the business is not limited to 300 square feet.

Simplified Method – The simplified method allows for a deduction equal to $5 per square foot of the home used for business, up to a maximum of 300 square feet, resulting in a maximum simplified deduction of $1,500. A taxpayer may elect to take the simplified method or the actual-expense method (also referred to as the regular method) on an annual basis. Thus, a taxpayer may freely switch between the two methods each year.

Additional office expenses such as utilities, insurance, office maintenance, etc., are not allowed when the simplified method is used. Prorated rent or home interest and taxes are not either, although 100% of home interest and taxes are deductible as non-business expenses if the taxpayer itemizes deductions.

Deducting the Cost of Business Equipment – From time to time, an owner of a small business will purchase equipment, office furnishings, vehicles, computer systems and other items for use in the business. How to deduct the cost for tax purposes is not always an easy decision because there are several options available, and the decision will depend upon whether a big deduction is needed for the acquisition year or more benefit can be obtained by deducting the expense over a number of years using depreciation. The following are the write-off options currently available.

Depreciation – Depreciation is the normal accounting way of writing off business capital purchases by spreading the deduction of the cost over several years. The IRS regulations specify the number of years for the write-off based on established asset categories, and generally for small business purchases the categories include 3-, 5- or 7-year write-offs. The 5-year category includes autos, small trucks, computers, copiers, and certain technological and research equipment, while the 7-year category includes office fixtures, furniture and equipment.

Material & Supply Expensing – IRS regulations allow certain materials and supplies that cost $200 or less, or that have a useful life of less than one year, to be expensed (deducted fully in one year) rather than depreciated.

De Minimis Safe Harbor Expensing – IRS regulations also allow small businesses to expense up to $2,500 of equipment purchases. The limit applies per item or per invoice, providing a substantial leeway in expensing purchases. The $2,500 limit is increased to $5,000 for businesses that have an applicable financial statement, generally large businesses.

Routine Maintenance – IRS regulations allow a deduction for expenditures used to keep a unit of property in operating condition where a business expects to perform the maintenance twice during the class life of the property. Class life is different than depreciable life.

| Depreciable Item | Class Life | Depreciable Life |

| Office Furnishings | 10 | 7 |

| Information Systems | 6 | 5 |

| Computers | 6 | 5 |

| Autos & Taxis | 3 | 5 |

| Light Trucks | 4 | 5 |

| Heavy Trucks | 6 | 5 |

Bonus Depreciation – The tax code provides for a first-year bonus depreciation that allows a business to deduct 100% of the cost of most new tangible property if it is placed in service during 2022. The remaining cost is deducted over the asset’s depreciable life. This provides a larger first-year depreciation deduction for the item. Bonus depreciation is a temporary provision and for eligible business property bought after 2022, the rates drop to 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026 and nothing after 2026.

Expensing – Another option provided by the tax code is an expensing provision for small businesses that allows a certain amount of the cost of tangible equipment purchases to be expensed in the year the property is first placed into business service. This tax provision is commonly referred to as Sec. 179 expensing, named after the tax code section that sanctions it. The expensing is limited to an annual inflation adjusted amount, which is $1,080,000 for 2022. To ensure that this provision is limited to small businesses, whenever a business has purchases of property eligible for Sec 179 treatment that exceed the year’s investment limit ($2,700,000 for 2022), the annual expensing allowance is reduced by one dollar for each dollar the investment limit is exceeded.

An undesirable consequence of using Sec. 179 expensing occurs when the item is disposed of before the end of its normal depreciable life. In that case, the difference between normal depreciation and the Sec. 179 deduction is recaptured and added to income in the year of disposition.

Mixing Methods – A mixture of Sec. 179 expensing, bonus depreciation and regular depreciation can be used on a specific item, allowing just about any amount of write-off for the year for that asset.

Advertising Expenses – Once the business is operating, all forms of advertising are generally currently deductible expenses, including promotional materials such as business cards, digital or print advertisements, and other forms of advertising. However any adverting expense incurred before a business begins functioning would be treated as a start-up expense. Trade shows are a form of advertising, and if a business purchases their own custom trade show booth, that booth can generally be expensed in the year purchased using bonus depreciation or Sec 179 expensing.

Website Costs – Although the IRS has not issued guidance on when Internet website costs can be deducted, the costs should generally be treated under the same principles as other business expenses. Generally, website costs will be either a software expense or an advertising expense, but if they are paid or incurred before a business begins, they would be treated as start-up expenses.

Financing – Interest expenses incurred to finance your business operation are deductible as a business expense. But be careful not to mix personal and business interest expenses. Banks are usually reluctant to lend money on a startup business. However, an equity loan on your home will generally achieve a lower interest rate anyway and the interest can be traced to and deductible as business interest.

Vehicle Expenses – If you use your car for business purposes you can deduct its business use by using either the standard mileage method, which allows a per mile amount, or the actual expense method. However, both methods require that you track your business and total mileage for the year. If using the standard mileage method you need to know the number of business miles driven, and if using the actual method you will need to prorate the actual operating expenses including fuel, insurance, repairs, and depreciation by the percentage of business miles to total miles. You can also deduct tolls and parking fees with either method.

Business Meals – Generally business entertainment is not deductible although business meals are 50% deductible, or 100% if the business meals are provided by restaurants during 2021 through 2022. The 100% deductibility provision is to encourage spending at restaurants, which generally were hard-hit by the COVID-19 pandemic emergency lockdowns. Record keeping for business meals is especially important. Each meal expense must be substantiated by not only the amount, date, time, and place, which are usually included on the receipt, but also the business purpose and the names of the guests and their business relationship.

Of course, the list of potential expenses goes on and is too extensive to include all possibilities here. If you are just starting a business or are already in business and have questions related to the business, please give our office a call.

Steps You Can Take to Grow Your Business to the Next Level

For small business owners, in particular, growing a business has always been something of a challenge. On the one hand, you don’t want to grow too quickly – doing so can significantly damage the trajectory that you’ve set out on. But at the same time, you also don’t want to grow too slowly as this too can cause you to remain stagnant and get passed by some of your competitors.

All of this is also true at higher levels, particularly when it comes to taking that pivotal stop from a $1 million business to a $10 million one. According to studies, most businesses generate about $500,000 in revenue – meaning that they just need to find that next step to get to the desired level. It’s certainly not an impossible feat as countless others have done it, but it is something that requires you to keep a few key things in mind.

Growing Your Business: Breaking Things Down

First, it’s important to acknowledge that getting to $10 million in revenue for your business isn’t actually “the hard part.” Most experts agree that getting to that $1 million level is far more difficult.

This ultimately comes down to the disparity between the concepts of “wealth” and “income” – two ideas that people sometimes have a hard time reconciling. Having an overall net wealth of $1 million is certainly an attainable goal. Getting to that point in one year may be less realistic.

Therefore, one needs to understand that ramping up the revenue of a business at the same pace is equally unrealistic. Once you learn to live by the idea of “slow and steady wins the race,” you put yourself in a much better position to succeed over the long term.

Indeed, this shift in mindset can pay dividends across the entirety of your organization. You need to re-evaluate your risk aversion, for example, so that you know which opportunities are worth capitalizing on and which must be passed by. You need to be objective with yourself about how tolerant you are to risk in the first place. You should also let that insight inform many of the decisions that follow.

Another way to grow your business from $1 million to $10 million (and beyond) also has to do with being realistic with yourself, albeit in a slightly different way. If your business has grown stagnant, you need to ask yourself why. Is it due to a legitimate lack of opportunity, or is it because of a general pessimism about what the future might hold? The latter is understandable to a certain extent, but it also stands in the way of the growth-minded leader that you need to be. It causes hesitation at moments when action is critical, and it is something that ultimately holds a lot of people back.

Another way to grow your business involves not just learning how to market, but learning how to market correctly. Marketing is a terrific avenue for not only keeping existing customers informed and satisfied but for attracting potential new ones as well. A certain amount of experimentation will be needed and you must spend time getting to learn as much as you can about your audience. Creating buyer personas is a great way to accomplish precisely that.

Finally, you also need to make a determination about what you value in terms of business in general. Some business owners don’t actually have an urge to grow – they’re perfectly fine existing exactly as they are right now. To be clear, there is absolutely nothing wrong with that. However, if you do have the mindset that growth is in your future, you need to prioritize it in a specific way.

You need to ask yourself WHY you want to grow. Is it for wealth, are you trying to expand, or do you want to leave a legacy behind for the next generation of your family? All of these are important questions to answer because they will dictate a lot of the decisions that you make moving forward.

In the end, growing from a $1 million business to a $10 million one isn’t an unattainable goal. It will, however, require you to adjust your mindset and follow crucial best practices like those outlined above.

If you’d like to find out more information about how to grow your business, or if you’d just like to speak to an accounting professional about your own needs in a bit more detail, please don’t hesitate to contact our office today.

Building Wealth Through Home Equity

Oftentimes, the first house a person buys is an affordable condominium, townhouse, or older single-family dwelling also referred to as a “starter home.” It might be small and lack features they dream about such as new appliances in the kitchen or dual sinks in the bath, to a large yard or a garage.

However, the key to a starter home is not to acquire your dream house, it is to build equity that you can eventually deploy to buy your dream home. It’s important not to wait until you have enough money for the ideal property. Start as early as you can and buy something affordable to get your foot in the door of homeownership.

Interest Rates and Maintenance Expenses

Buying a home when mortgage interest rates are low offers a key advantage for building wealth because it reduces your loan payment, thereby freeing up more discretionary income to put toward other investments, home upgrades, or paying down the mortgage balance.

When deciding your price range for purchasing a home, it’s also important to budget common maintenance costs, such as utilities, repairs, and upgrades, as well as homeowner’s insurance and property taxes. These costs can be substantial, yet many new homebuyers do not account for them in their budget. They only take into consideration whether or not they can afford the monthly mortgage. It is always a good idea to have a lower payment that you can well afford in order to avoid relying on savings or credit to pay for maintenance expenses as they arise. And remember, maintenance of your property is critical because it can help improve the sale price when you move, which is key to building wealth.

Building Home Equity

The next step to building wealth through homeownership is to sell for a substantial profit. Home equity, which is the market price for which you can sell the home minus your remaining mortgage balance, is achieved in two ways. One way to build equity relies on the real estate market. Over time, houses generally increase in price, so most people are able to sell their home for more than they paid for it. How quickly home prices rise depends on the overall economy and your home’s particular appeal. That’s why it’s important to make an attractive location one of your top requirements. For example, even if you don’t have children or want children, buying a home in a sought-after school district will likely increase the value of your home faster. Other location features include easy access to shopping districts, major highways, and even an airport.

The second way to build equity is through the monthly payments you make on the mortgage, which reduce the balance owed. If you can afford it, adding more to your monthly payment and directing the excess toward your principal balance helps build home equity faster. Another payment option that can help build equity faster is to apply for a shorter-term loan than the standard 30-year mortgage. For example, a 15-year term mortgage features a lower interest rate and the borrower pays off the loan in half the time. Note that monthly payments will be higher, but a homeowner can save thousands of dollars in interest with a shorter-term loan.

Transaction Costs

The garden-variety advice is to remain in your home for at least five years. That’s because selling your home and buying a new one involves substantial transaction expenses, from closing costs to initiating a new loan, as well as paying commission fees to both the seller’s and buyer’s real estate agents (usually three percent each). Therefore, you need to have lived in the property long enough to build equity through payments and market appreciation to offset these expenses and still make a profit.

Sales Tax

Be aware that it is advantageous to live in your primary residence for at least two years before selling. Otherwise, your sales profit could be subject to capital gains taxes on the first $250,000 for single tax filers, and as much as $500,000 for married filing jointly. The tax rate is the same as your ordinary income tax rate if you owned the property for less than one year; after that, the capital gains rate is based on your tax bracket (15 percent or 20 percent).

Trade Up, Then Down

Over many decades, you can build wealth by buying a home and then periodically “trading up” once you attain substantial equity. The tactic of trading up means you invest your profits in a more expensive home and then begin building equity again. One way to save for retirement is to keep trading up until you retire, then downsize to a less expensive home with lower maintenance expenses. At that point, you can redeploy the profit derived from the home equity you have accumulated into a stream of retirement income.

Today’s Market

In recent years, high prices and low inventory in the residential real estate market have made it harder for young adults to buy a starter home. For those currently shut out of the market, keep saving until the market stabilizes, because the higher your down payment, the lower your monthly payments will be – and the more equity you’ll have in your home. You can still build wealth through homeownership, even if you start late.

UPDATE: The Inflation Reduction Act: A Brief Overview of Potential New Legislation

On August 7, the U.S. Senate voted to pass the Inflation Reduction Act (IRA). The enormous bill—clocking in at 725 pages—contains a wide range of provisions and comes with a nearly $750 billion price tag. “The bill is fighting inflation and has a whole lot of collateral benefits as well,” said former Treasury Secretary Larry Summers, who reportedly helped craft the legislation.

While there are still hurdles to summit before the bill becomes law, it is important to remain aware of what is potentially in the works. Read on for an overview of the key items contained in the new act.

Provisions for Funding the IRA

In order to cover the $750 billion price tag of the IRA, the authors of the legislation included a variety of savings- and revenue-related provisions. Here is a breakdown of how the IRA will be funded (please note that the numbers are estimates from the Joint Committee on Taxation and the Congressional Budget Office):

- Savings in the Healthcare Arena ($288 billion)

- Repeal of a Trump-era drug rebate rule

- An inflation cap on drug prices

- An allowance for Medicare to negotiate certain drug prices

- New Revenue

- A new 15% corporate minimum tax for corporations with financial statement (“book”) income exceeding $1 billion ($313 billion)

- Increased revenue as a result of IRS tax enforcement funding ($124 billion)

- A 1% excise tax on corporate stock buybacks

- Methane and Superfund fees

How IRA Funds Will be Spent

So how will the $750 billion raised via savings and new revenue be spent? Here is a brief overview of initiatives included in the IRA (please note that the numbers are estimates from the Joint Committee on Taxation and the Congressional Budget Office):

- Climate & Energy Spending ($369 billion)

- Creation of new clean manufacturing tax credits

- Establishment of additional clean electricity grants and loans

- Creation of a new “Clean Energy Technology Accelerator”

- Incentivization of clean agriculture

- Incentivization of clean electronic vehicle manufacturing

- Additional energy and climate provisions

- Healthcare Spending ($64 Billion)

- A three-year extension of Obamacare subsidies for health care insurance costs

- A redesign of Medicare Part D and additional health care provisions

- IRS Funding

- Funding for increased IRS enforcement (namely, to enhance IT systems and compensate specialized employees—for more details, read IRS Commissioner Charles Rettig’s letter on the intended use of funding and plans for enforcement)

- Other Spending

- Reducing the Federal deficit ($300+ billion)

What’s Next?

Now that the IRA Act has been approved by the Senate, it heads to the House. The new legislation is expected to pass easily in the Democratic-controlled body. Timing is yet to be announced; however, it is likely to move relatively quickly. Upon passage in the House, the IRA will be brought to President Biden for his signature.

As with any legislation in progress, details about the IRA remain up in the air until it is enacted by the President. Please be assured that your Ross Buehler Falk & Company, LLP accounting advisors are keeping a close watch on the progress of the IRA and will keep you apprised of any major developments.

Sources

- https://www.washingtonpost.com/us-policy/2022/07/28/manchin-schumer-climate-deal/

- https://finance.yahoo.com/news/inflation-reduction-act-how-a-new-bill-would-lower-costs-for-americans-200724803.html

- https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/07/28/remarks-by-president-biden-on-the-inflation-reduction-act-of-2022/

- https://www.vox.com/policy-and-politics/23282983/inflation-reduction-act-kyrsten-sinema-josh-gottheimer

- https://www.cnn.com/2022/08/07/politics/senate-democrats-climate-health-care-bill-vote/index.html

- https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_one_page_summary.pdf

The IRS is Auditing Fewer Returns than Ever

One of the perennial fears of taxpayers is getting audited by the IRS. Financially, few scenarios strike such fear into hearts. However, taxpayers can probably breathe a sigh of relief – at least for now. This is because the rate at which the IRS is initiating audits of individual taxpayers is dropping like a stone.

Decline in Audit Rates

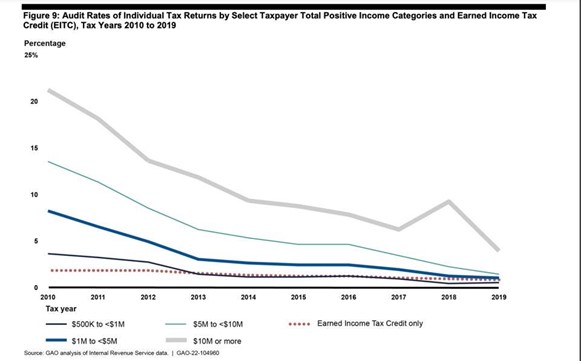

The rate at which the IRS is auditing individual taxpayers has declined overall between the years 2010 and 2019 (2020 data is too new and 2021 returns are still being filed through the extension period). According to the Government Accountability Office (GAO), nearly 1 percent of all taxpayers were audited in 2010, compared to only 0.25 percent for the tax year 2019. The GAO chart below shows the ski slope-like drop in individual tax audit rates over the period.

While the IRS continues to audit higher-earning taxpayers more often overall, during the 10 years charted, audit rates consistently declined for all levels of taxpayers, except those with the highest incomes. The audit rate for taxpayers with income between $200k and $500k experienced the largest drop, with the audit rate declining from 2.3 percent down to 0.2 percent; a 92 percent reduction in audits. Taxpayers with the highest incomes, defined as $10 million or more, saw a resurgence in audit rates from 2017-2018; however, even they experienced an overall decline, dropping from 21.2 percent in 2019 to only 3.9 percent in 2019 – equating to an 81 percent decline.

Impact on the Treasury

There is a theory that the prospect of a tax audit leads to greater voluntary compliance. In other words, if people think they won’t get audited, then they are more likely to cheat on their taxes.

Non-compliance with tax laws and regulations has a material impact on the Treasury. According to the IRS, it is estimated that on average, individual taxpayers under-reported nearly $250 billion a year for the period 2011-2013. This leads to the non-collection of taxes that are otherwise owed to the government and raises issues of fairness for taxpayers who are playing by the rules.

Why the Decline in Audit Rates?

One of the main drivers is a lack of resources at the IRS, a combination of both reduced funding and fewer auditors on staff. The number of agents working for the IRS has declined across the board since 2011. Tax examiners, the type who handle basic audits by mail, have dropped by 18 percent. Meanwhile, revenue agents, who handle the more complex cases in the field, declined by more than 40 percent over the same period.

Demographics point to an increase in these trends as there is a wave of coming retirements in the IRS. Over the next three years, nearly 14 percent of current tax examiners and 16 percent of revenue agents are expected to retire. Stack on top of this is the fact that the inexperience of newer agents and the time to complete audits is also taking longer.

Conclusion

The IRS claims it is missing out on millions in legally due tax revenues due to the inability to maintain enforcement. They say they need more funding to hire more agents to perform more audits, which not only find fraud in the audits themselves but also increase overall compliance due to the pressure this creates.

Currently, there is no political focus on bringing significant new resources to the IRS, so we are not likely to see an uptick in individual tax audit rates anytime soon. The trend of focusing on the highest earners, however, will likely continue as this is where the IRS can find the most bang for its buck.

The Inflation Reduction Act: A Brief Overview of Potential New Legislation

On July 27, the legislative text of the Inflation Reduction Act (IRA) was made public. The enormous bill—clocking in at 725 pages—contains a wide range of provisions and comes with an $800 billion price tag. “The bill is fighting inflation and has a whole lot of collateral benefits as well,” said former Treasury Secretary Larry Summers, who reportedly helped craft the legislation.

According to a recent article from Vox, there are three big questions when it comes to the passage of the IRA:

- Will Arizona senator Kyrsten Sinema support the IRA?

- Will Democratic House moderates support the IRA?

- Will a vote on the IRA occur prior to the Senate’s annual summer recess, which is scheduled to begin on August 8?

While there are many hurdles to summit before the bill becomes law, it is important to remain aware of what is potentially in the works. Read on for an overview of the key items contained in the new act.

Provisions for Funding the IRA

In order to cover the $800 billion price tag of the IRA, authors of the legislation included a variety of savings- and revenue-related provisions. Here is a breakdown of how the IRA will be funded:

- Savings in the Healthcare Arena – $320 Billion

- Repeal of a Trump-era drug rebate rule ($120 Billion)

- An inflation cap on drug prices ($100 Billion)

- An allowance for Medicare to negotiate certain drug prices ($100 Billion)

- New Revenue – $470 Billions

- A new 15% corporate minimum tax ($315 Billion)

- Increased revenue as a result of IRS tax enforcement funding ($125 Billion)

- Closure of the carried interest loophole ($15 Billion)

- Methane and Superfund fees ($15 billion)

How IRA Funds Will be Spent

So how will the $800 billion raised via savings and new revenue be spent? Here is a brief overview of initiatives included in the IRA:

- Climate & Energy Spending – $385 Billion

- Creation of new clean manufacturing tax credits ($40 Billion)

- Establishment of additional clean electricity grants and loans ($30 Billion)

- Creation of a new “Clean Energy Technology Accelerator” ($30 Billion)

- Incentivization of clean agriculture ($30 Billion)

- Incentivization of clean electronic vehicle manufacturing ($20 Billion)

- Additional energy and climate provisions ($235 Billion)

- Healthcare Spending – $99 Billion

- A three-year extension of Obamacare subsidies for health care insurance costs ($64 Billion)

- A redesign of Medicare Part D and additional health care provisions ($35 Billion)

- IRS Funding – $80 Billion

- Funding for increased IRS enforcement

- Other Spending – $305 Billion

- Reducing the Federal deficit

Conclusion

As with any legislation in progress, pretty much everything about the IRA remains up in the air until it is enacted by the President. Please be assured that your Ross Buehler Falk & Company, LLP accounting advisors are keeping a close watch on the progress of the IRA and will keep you apprised of any major developments.

Sources

- https://www.washingtonpost.com/us-policy/2022/07/28/manchin-schumer-climate-deal/

- https://finance.yahoo.com/news/inflation-reduction-act-how-a-new-bill-would-lower-costs-for-americans-200724803.html

- https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/07/28/remarks-by-president-biden-on-the-inflation-reduction-act-of-2022/

- https://www.vox.com/policy-and-politics/23282983/inflation-reduction-act-kyrsten-sinema-josh-gottheimer

2022 – 23 PA State Budget Brings Corporate Tax Cut, Changes to Personal Income Tax

Pennsylvania passed its budget for the 2022 – 23 fiscal year on July 8, 2022. While the main purpose of the annual budget is to allow the state to continue to pay its bills, it is also the primary source of tax law changes in Pennsylvania. The recently passed budget brings a long-sought reduction to the Corporate Net Tax Income Tax (CNIT)

Reducing Pennsylvania’s 9.99% Corporate Net Tax Income Tax (CNIT) has been a matter of concern among policymakers for the past decade. The recently passed budget includes a reduction of the corporate tax rate to 8.99% for the 2023 tax year. This rate will continue to drop by half a percent each year until it reaches 4.99% in 2031.

For an in-depth analysis of the recent CNIT cut and what it means for the future of corporations in the commonwealth, click here.

Additionally, the new budget increases the amount of fixed assets that individuals can immediately expense from $25,000 per year to $1,080,000, which matches the federal limit for 2022. The federal expense amount is adjusted annually for inflation.

Please reach out to your RBF tax professional with any questions regarding these or any other recent PA state tax legislation changes. We are always happy to help!